Hodl Up! Your weekly crypto catch up: Week 34 '25

Ethereum has hit a new All Time High, yes, you read it right. Altcoins are gaining interest just like before and has Pump fun finally regained its stronghold in meme launchpads back? This week on...

Most of the weeks when I write this weekly newsletter on Saturdays, the case has been that the market would be great throughout the week and drop off on Fridays and then in the newsletter I have to mention lower numbers but this is one of the few times when the market was shit throughout the week but really bounced on Friday.

And by really bounced, I mean bounced like $ETH all time high bounced. Yes, we couldn’t hold it for a long time and go past $5,000 but the signs are all there and trust me when I tell you - I’ll be crazy surprised if rates cut don’t happen now and they are not followed by a $5,000 $ETH.

The retail interest in altcoins has increased by quite much in the last few months, with google interest at a 3-4 high year high. Altseason could be soon, ladies and lads.

And finally, we’ll have a discussion on how Pump Fun has been regaining its dominance in the meme launchpad game after Bonk’s early rise.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

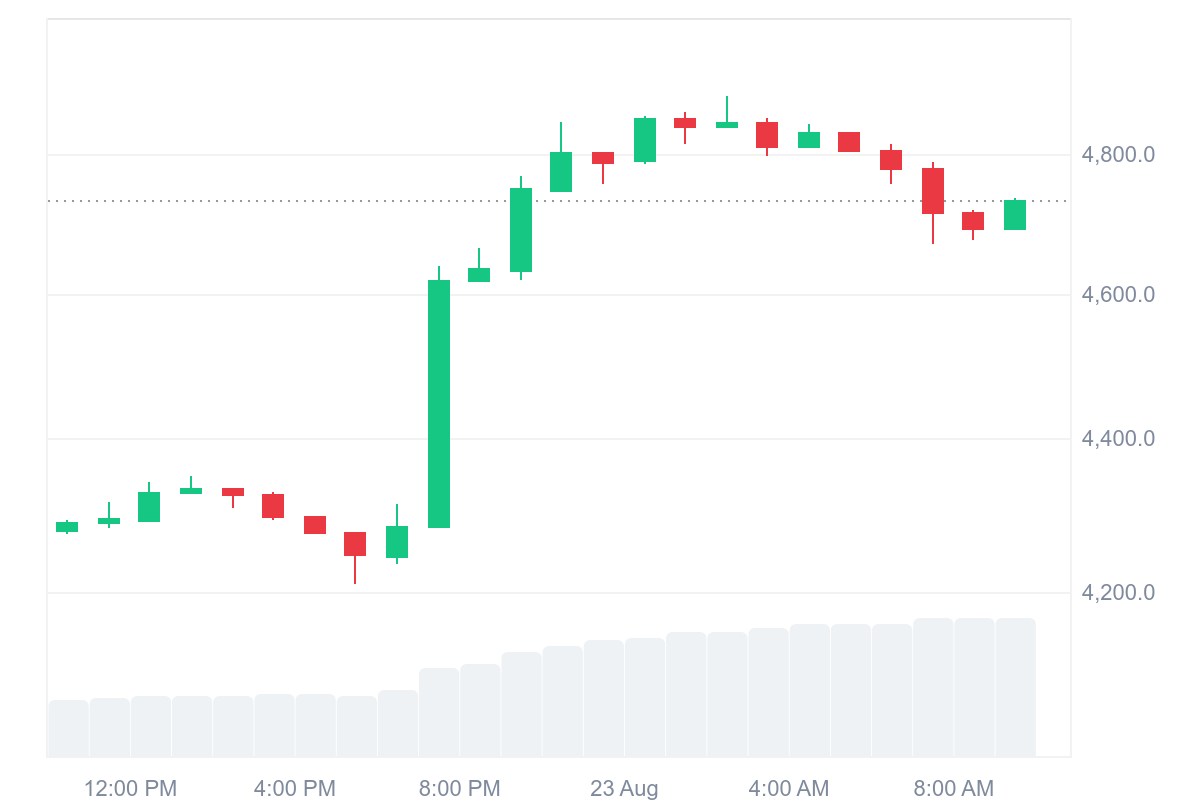

$ETH - A New All Time High

Well, well, well… how the turn tables? $ETH just did the unthinkable, or at least the long-awaited and shattered its previous all-time high, surging to a whopping $4,882 on Friday. That’s right. After nearly four years of being the “maybe-next-cycle” token, ETH has finally reminded the world it’s still got it. If you’ve been holding through the brutal bear market, the never-ending crab walk, and the endless ETH/BTC ratio jokes, congratulations. This one’s your victory lap.

Let’s not sugarcoat it, 2024 was a dumpster fire for Ethereum. ETH was being called “tech debt with a token,” and every time it pumped a little, it felt like a setup for another faceplant. Honestly, ETH spent most of last year being the butt of every joke in the crypto universe and not without reason. The price action was uninspired, sentiment was in the gutter, and hope felt like a distant memory.

But as every seasoned degen knows, the market loves a comeback story and Ethereum just gave us a spectacular one. The spark? None other than Jerome Powell himself. Yep, the Fed Chair who once struck fear into risk assets everywhere now seems to have given ETH the green light. At the Jackson Hole Economic Symposium on August 22, Powell hinted at possible rate cuts as early as September. That one gentle nudge from the macro gods was enough to send markets into overdrive. Stocks rallied. Bitcoin popped. But Ethereum? Ethereum erupted. It didn’t just cross resistance, it broke through it like Brock Lesnar Vs Kofi Kingston (those who know, know).

With ETH now closing in on the mythical $5,000 mark, the question isn’t “if,” but “when.” And if the Fed actually delivers on those rate cuts next month? You might want to keep your notifications on because that push could be all it takes for Ethereum to finally break through that five-digit ceiling.

This isn’t just about price action. It’s a vibe shift. Institutional investors are waking back up to ETH. Spot ETFs are starting to attract fresh inflows. The L2 ecosystem is maturing. Dev activity is humming. And let’s be honest: when Ethereum moves, the rest of crypto pays attention. The energy is back. The memes are back. The hopium has real fuel now.

So here we are, on the brink of history, again. Ethereum has dusted itself off, kicked down the doors of 2021’s all-time high, and is staring down $5K like it’s dessert. If you held through the noise, the FUD, and the financial gaslighting, take a bow. You earned this moment.

And to all the ETH bears who laughed during the downtrend… I guess we’re not laughing anymore, are we?

Pump Vs Bonk: Round Two

Src: CMC, Dune

If you’ve been following the Solana memecoin scene this year, you know it’s been a wild tug-of-war between two major players: Pump.fun and LetsBONK.fun. For a while, Pump.fun was the undisputed king of the launchpad world. It had everything going for it - simplicity, speed, and a massive user base that had minted millions of tokens. Then in late April, LetsBONK.fun entered the arena and shook things up in a big way.

Backed by the BONK community and boasting a slick interface, LetsBONK made it insanely easy to launch tokens and immediately list them on DEXs. Within just a few days, it racked up thousands of new launches and pulled in hundreds of thousands in fees. It didn’t stop there, by July, it had actually overtaken Pump.fun in just about every metric that matters: tokens launched, daily revenue, even number of tokens hitting million-dollar market caps. At its peak, LetsBONK was doing more than double the daily volume Pump.fun was pulling in. The memecoin crowd had shifted their attention, and it was looking like a new top dog had arrived.

Meanwhile, Pump.fun was stumbling. They had just launched their token, $PUMP, through a massive public sale: we’re talking hundreds of millions raised but the market didn’t love it. The token price spiked briefly after launch, then tanked as early buyers dumped and users started asking what utility $PUMP actually had. Combine that with a loud narrative that the ICO was a cash grab, and Pump.fun’s once-bulletproof reputation took a serious hit.

But here’s the twist, August brought the comeback story no one saw coming.

Pump.fun went into full redemption mode. They started buying back $PUMP from the open market with over $1 million worth a day, consistently. It wasn’t just a short-term pump either. They backed it with real revenue - remember, this is a platform that had already brought in over $800 million since launch. They also teased airdrops, hinted at new community initiatives, and basically reignited the spark that had made them the top launchpad in the first place.

And it worked. By mid-August, Pump.fun had flipped the script. It was once again leading in token launches, pulling in the majority of Solana launchpad revenue, and seeing its daily volume soar. $PUMP even bounced off its lows and showed signs of life, thanks in part to the buybacks and a stronger narrative around future utility. Traders came back. Degens came back. Even the skeptics had to admit: Pump.fun got its mojo back.

LetsBONK isn’t dead, not by a long shot, it still has a strong community and solid daily activity. But the battle for launchpad supremacy in August wasn’t even close. Pump.fun came out swinging, and for now, the crown is firmly back on its head.

We’ll need to keep an eye on the round three of these heavyweights next.

Is Interest For ‘Altcoins‘ Back?

People are Googling “altcoins.” No, not just a few curious clicks from that one friend who still thinks Dogecoin is a personality trait (I am that friend, I am sorry). We’re talking about a surge to the highest search volume since 2021, according to Google Trends.

That’s right, the magical “altseason” keyword is back in the wild, and for those of us who’ve been here before… we know what this usually means.

When the general public starts hunting for “altcoins,” it’s not because they’re suddenly fascinated by layer-1 consensus models or zero-knowledge rollups. It’s because prices are moving, gains are happening, and group chats are lighting up with messages like “Is it too late to get in?” or the classic “What even is a Pepe coin?”

But times are changing. With ETH finally breaking out and macro tailwinds starting to blow (thanks Jerome!), people are getting that familiar itch. The “What else is out there?” energy is creeping back in. And you can feel it, retail is sniffing around again, influencers are firing up their YouTube thumbnails, and that one guy who disappeared after buying at the 2021 top? He’s suddenly active on Telegram again.

Of course, seasoned folks know the rules here: when interest in altcoins spikes, volatility follows, opportunities multiply, and new narratives emerge every other hour. It’s chaotic, it’s thrilling, and yes, it’s slightly dangerous. But that’s part of the fun, isn’t it?

So what’s next? Historically, rising altcoin search interest has correlated with inflows into mid- and low-cap projects and if $ETH really does break the magical number of $5,000 - could we see a HUGE altcoin rally? We’ll have to wait and watch.

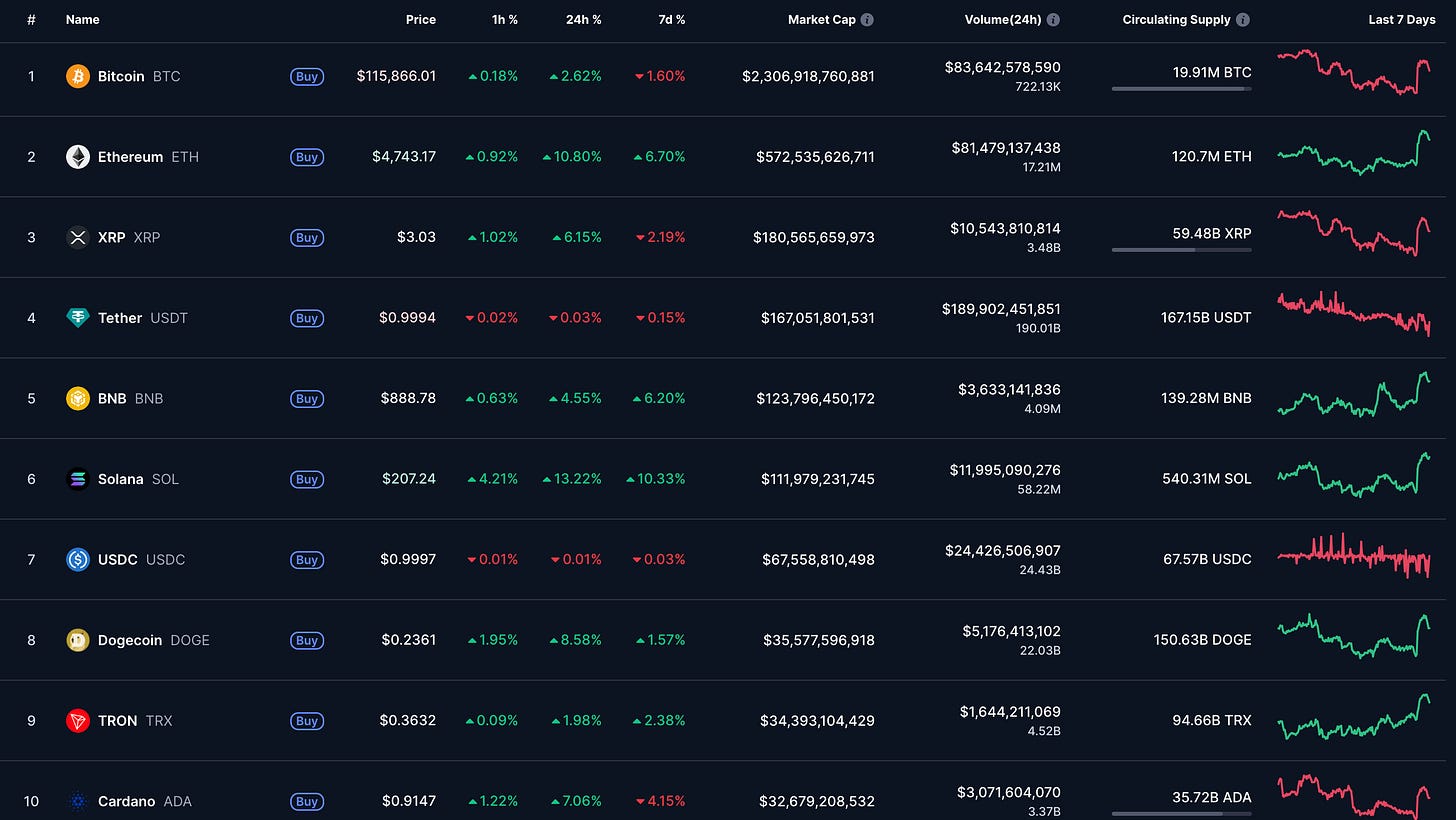

A Look At The Markets

After the initial crash early week, $ETH showed immense strength and pumped by more than 13% yesterday before cooling down a bit.

Seeing for the week, the market cap has increased from $3.96T to $4T but the momentum seems super strong. Strong to the point that we might have a $5,000 $ETH even before the rate cuts. Will we?

Biggest Winner

$OKB: I mean again, wow. It was so good, $OKB decided to do it twice. This is just remarkable. $OKB has now pumped 344% in the last one month. From $49 to $250 ($215 at the time of writing).

Crazy.

Biggest Loser

$PI: I really feel for these guys sometimes. I don’t know when will there time come. Hopefully soon.

Well, this is it for this week on HodlUp! Hopefully, next week is just as exciting and crazy in crypto and we see even more action. Till then, stay safu!

Oh oh oh, before we go: We finally have a sponsor guys, yes, we do. This week’s HodlUp! was sponsored by EarnMax: a crypto-powered subscription service that gives you weekly lottery tickets for a chance to win USDC on Arbitrum. So, if you’re interested - do click here and join: https://max.earnm.com/our-crypto-talk