Hodl Up! Your weekly crypto catch up: Week 47

Take Bitcoin to $100k, Take Bitcoin to $100k , Take Bitcoin to $100k. That's what we want at Our Crypto Talk

The crypto industry seems to be in the greatest party mode ever. $BTC is sitting at $98,644 as I write this newsletter on this fine Saturday morning and we have already had Bitcoin touch $99,655 yesterday.

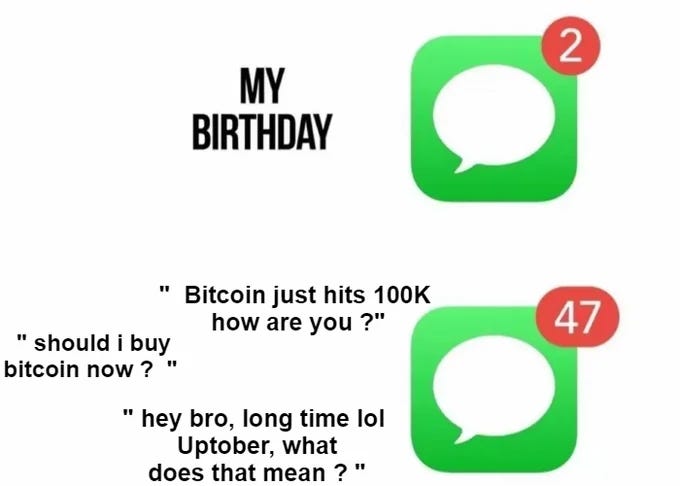

Everyone has just one thing on their mind - a 100,000 dollar Bitcoin. We’ll discuss how big of an event that would be and also how close are we to the alt season. And oh yes, our good friend Solana made an ATH of its own; so everyone except Ethereum guys are happy.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

What would a $100,000 Bitcoin mean?

Bitcoin at $99,600 and knocking on the door of $100,000 is more than a milestone; it’s a moment of reckoning. With President Donald Trump embracing Bitcoin as a symbol of American innovation, the cryptocurrency’s impending six-figure mark could redefine the global financial landscape. Let’s dive into what this means for the finance industry, equities and assets, and the crypto ecosystem—with a sprinkle of optimism and humor.

The Financial Industry: Bitcoin Enters the Big League

For the finance sector, Bitcoin at $100,000 signals its transformation from speculative asset to institutional heavyweight. Wall Street would no longer be able to dismiss Bitcoin as “magic internet money.” Banks may find themselves competing with—or adopting—blockchain-based financial products. With Trump advocating a Bitcoin reserve for the U.S., central banks worldwide might scramble to acquire their own crypto reserves, leading to what some could call “The Great Digital Arms Race.” Expect old-school bankers sipping coffee nervously as they Google “how to mine Bitcoin.”

Equities and Assets: Ripple Effects Across Markets

A Bitcoin boom to $100,000 could prompt a reallocation of traditional investments. Gold might see its shine dimmed as digital gold rises, with younger investors favoring the decentralized asset over bullion. Equities, especially those tied to technology and finance, could ride the Bitcoin wave, as companies like MicroStrategy and Coinbase set records. Even meme stocks could have their resurgence, because, in the end, why not? Meanwhile, the housing market might see competition from tokenized real estate, where digital ownership becomes more tangible than deeds.

The Crypto Industry: The New Era of Adoption

Bitcoin’s ascent would catapult the entire crypto market into the spotlight. Altcoins might see price surges as retail and institutional investors diversify within the space. Decentralized finance (DeFi) could experience a renaissance, with Bitcoin as the anchor. However, scalability issues and regulatory frameworks will need addressing to support the new wave of adoption. And yes, your local café might finally accept Bitcoin—not just as a gimmick but as the future of payment.

At $100,000, Bitcoin could prove that the world isn’t just ready for the digital economy; it’s embracing it with open arms. Let’s hope it also teaches us to save those private keys a little more carefully.

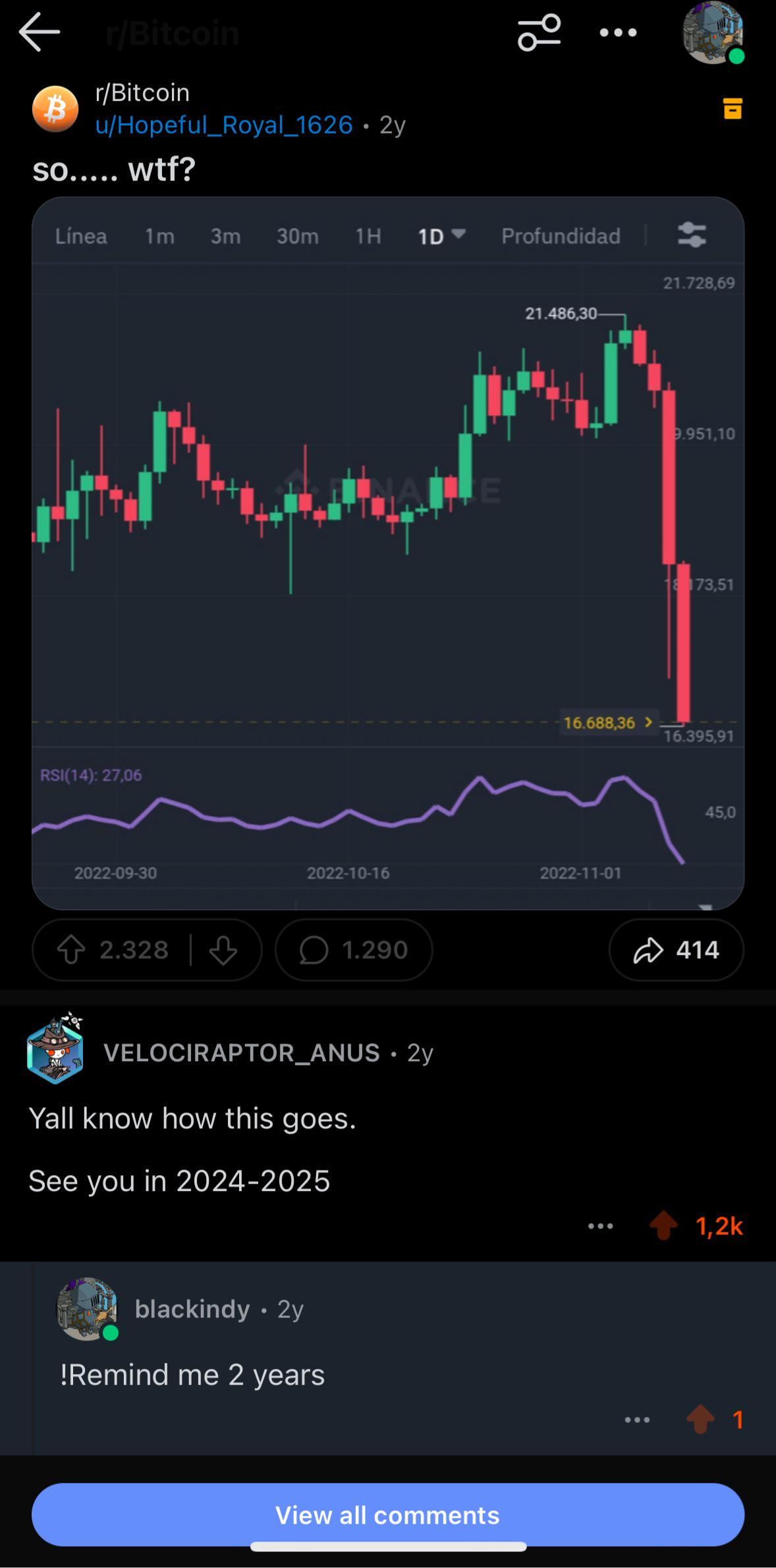

As for the long term holders

As they say, there will be signs 🤷

At the cusp of alt season

Let’s just see the 7 day change percentages of some selected altcoins:

Solana: +18%

XRP: +65%

Doge: +25%

ADA: +42%

AVAX: +26%

These are 5 of the 10 largest crypto assets in the world. The rest being Bitcoin (new ATH), USDT & USDC (Stables), BNB (+105% YTD) and ETH.

The alt season seems to be well on its way and what’s even more surprising is that Ethereum has not shown the movement we usually associate with an alt season.

If we look at the alts all time chart, we see that the ATH in terms of market cap for alts was in the first week of Nov 2021. Guess which project had its ATH in the same week? You guessed it - Ethereum.

Now look at the last candle on this chart, this great green candle that we see here which added around $350-400 Billion into the alt market cap. This has nothing to do with Ethereum, $ETH has probably been the most disappointing alt project in the top 10 as we saw above.

What do we interpret from this? We can see it in two ways IMO:

This is not even the start of the altseason. The altseason we will get on $ETH hitting a new all time high would be explosive.

$ETH is done for. It might even be flipped by Solana in the coming years.

I won’t tell you which one is right or wrong because I do not know. I sure pray to god it is the first one though.

Let’s see some inspiring images surrounding the bull run before I sign off.

Yes yes, bear with me as I show you some of my favourite images surrounding the happiness in the industry. But I want to share this happiness, so let’s do that.

With the lively markets right now, we will resume our mid week newsletter as well focusing on one particular topic in the industry. But till then, stay SAFU.