Hodl Up! Your weekly crypto catch up: Week 49

It is the $100k party in the Bitcoin world with now even Ethereum joining the pump. Markets, money and pumps - the main focus of week 49 of Hodl Up!

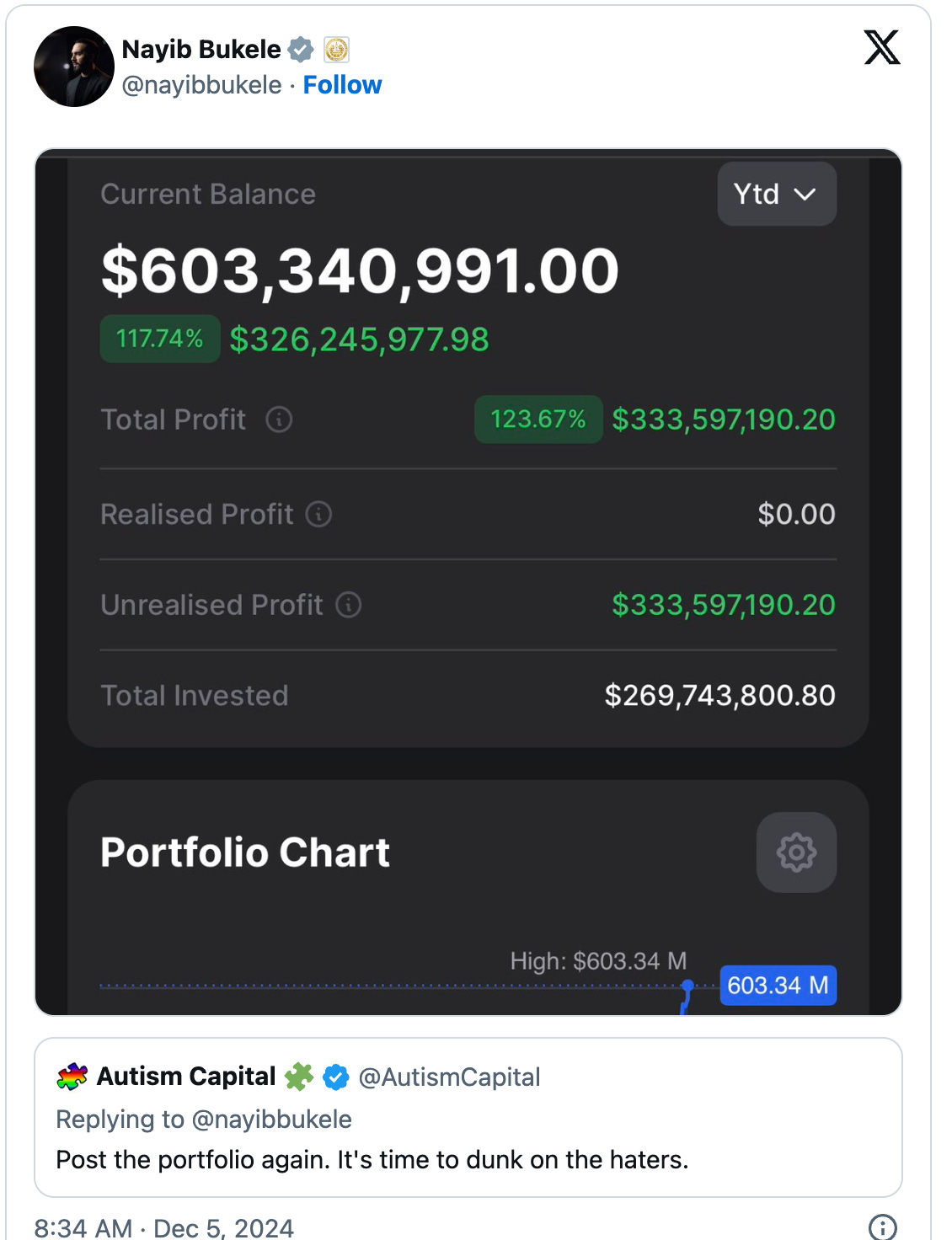

Bitcoin reached $103,900 on Dec 05, 2024. For something that could be described as nothing less than monumental, the kind of calm that industry leaders and communities have shown - just goes to show how far have we come. Yes, an event for sure but there is a belief that this is the launching pad for something even larger, a shift in the financial system of the world as we know it.

Not just that, Ethereum joined the party the very next day, hitting the elusive $4,000 mark on it’s way to a potential $1 Trillion market cap if ETH maxis are to be believed.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Bitcoin climbs the $100k mountain - who said what?

“Bitcoin continued to be highly volatile — it went up a lot, and it went down a lot, too. There’s been multiple 30%, 50% or 90% drawdowns. That type of volatility usually would scare off many people. But instead, each one of you that actually held Bitcoin — you probably did it in the face of your friends or your family telling you how you were dumb, how you were wasting your time or your money. They tried to discourage you, but every single one of you ignored all the noise. Instead you did the work, you learned, and you figured out exactly what Bitcoin was, and you started to accumulate whatever you could.”

- Anthony Pompliano

“If you bought $100 of Bitcoin when Coinbase was founded in June 2012, it would now be worth about $1,500,000. If you kept the $100 USD you'd only be able to purchase about $73 worth of goods today. Bitcoin is the best performing asset of the last 12 years, and it's still early days. Every government, especially those looking to create a hedge against inflation, should create a Bitcoin strategic reserve. Happy Bitcoin $100k day.”

- Brian Armstrong

There were a plethora of other reactions on X too but the most important one is obviously mine, since I am writing this newsletter.

In my personal opinion, I think this is a benchmark for the future. Do I believe we will see a massive crash in the future? Hell yes. Do I think Bitcoin will recover from that crash and go even further up? Double hell yes.

The amount of institutional money and government interest in Bitcoin is an all time high along with its price and I don’t think people realise how big the long term implications of this thing are. There’s a lot of political movement in the world but when have we not had political movement? It is all about patience for the long term holders and taking profits to the money makers.

A very interesting thing would be to see whether $BTC will fall below $69k in the next bear run. NFA but I think no.

How did we reach at $100k ?

$0.06: 'Magic internet money' (2010)

$32: First 'bubble pop' -94% (2011)

$266: Cyprus bank crisis boost (2013)

$1,242: China's first ban (2013)

$86: Mt. Gox collapse (2014)

$20K: 2017 retail FOMO peak

$3.2K: 'Crypto winter' bottom (2018)

$3.8K: COVID crash (Mar 2020)

$69K: ATH pre-FTX (Nov 2021)

$15.7K: FTX collapse (Nov 2022)

$42K: GBTC unlock fears (2023)

$48K: ETF approval (Jan 2024)

$100K: We are here

Bitcoin has embarked on an extraordinary journey, transforming from an experimental digital currency worth $0.06 in 2010 to a global financial force valued at $100,000 in 2024. This milestone marks a triumph for blockchain technology, decentralization, and a revolution in how the world perceives money.

When Bitcoin launched in 2009, it was met with skepticism and curiosity. In 2010, the now-famous "Bitcoin Pizza Day" saw two pizzas purchased for 10,000 BTC, highlighting its humble beginnings. By 2013, Bitcoin surpassed $1,000, capturing mainstream attention as an alternative to traditional currencies. This period of growth was fueled by the narrative of financial sovereignty and a hedge against inflation.

The 2017 bull run brought Bitcoin to $20,000, as initial coin offerings (ICOs) and blockchain innovation captured imaginations worldwide. Despite a severe market correction in 2018, Bitcoin proved resilient, rebounding in 2020 amidst global economic uncertainty. Institutional adoption skyrocketed, with companies like MicroStrategy and Tesla adding Bitcoin to their balance sheets.

The approval of Bitcoin exchange-traded funds (ETFs) in 2024 added legitimacy and accessibility, propelling its value further. Today, Bitcoin at $100,000 symbolizes not just financial gains but the realization of a vision—a decentralized, borderless digital economy.

And if you’re not down with it, I’ve got three letters for you - LFG 🚀

$XRP - We got to talk about it too

$XRP on 8th November : $0.54

$XRP on 2nd December: $2.92

$XRP at the time of writing: $2.42

The price of $XRP 4x’d in just the last 30 days. The shackles have been removed from Ripple after Gary Gensler’s resignation and Donald Trump’s victory.

Here are the top reasons behind XRP's impressive comeback in 2024 (as researched by my friend Chat, whose last name is GPT):

Legal Wins Against the SEC: XRP's resurgence stems significantly from Ripple's victories in its ongoing legal battle with the SEC. Key court rulings, such as Judge Analisa Torres's decision affirming XRP's non-security status in certain contexts, boosted investor confidence.

Strategic Partnerships: Ripple's alliances with financial institutions worldwide have enhanced XRP's utility, particularly in cross-border payments. These partnerships have solidified XRP's position in the market.

Regulatory Clarity and Pro-Crypto Policies: The U.S. administration under President Trump, with a crypto-friendly approach, has created optimism. Proposed frameworks and appointments of pro-crypto regulators have reduced uncertainty, benefiting XRP and the broader cryptocurrency market.

Market Sentiment and Utility Expansion: The broader acceptance of cryptocurrencies, driven by advancements in tokenization and real-world use cases, has lifted market sentiment. XRP's efforts to develop its ecosystem have also contributed to its increasing adoption.

Adoption in Remittances and Payments: Ripple's focus on cross-border remittances and its integration into financial systems have proven pivotal. Use cases for XRP as a bridge currency have further fueled its growth.

$XRP sits at third in market cap now, as some $XRP holders say - is its rightful position.

A look at the markets

Perhaps the most bullish it has been since we began this newsletter. A joy to see the market at $3.66T of market cap. Can we get to $4T in this run?

Biggest Winner

Bitcoin: Yes, we won’t even talk about anyone else here. Bitcoin is the king.

Biggest Loser

$BONK : It’s alright $BONK, you’ve already doubled in 30 days, no harm in correcting this week. 5% dip in $BONK.

C4 (Crazy Crypto Community Content)

Content 1

Being optimistic is one thing, being crazy is another. We add another level to it - being Amonyx.

Content 2

Well Bitcoin did give a big FU to someone here.

That’s it for this week lads and ladies. Until next week, stay SAFU!

Hi