Hodl Up! Your weekly crypto catch up: Week 35 '25

A bad week in the markets but ETH has been outperforming Bitcoin in ETF performance, the number of Bitcoin whales has been shooting up and is Google finally entering the blockchain game?

Another very happening week in crypto. The markets moved, definitely, but not in the direction we would have wanted it to. All me crazy but I always prefer the movement over stagnancy, I guess I live for this volatility.

ETH has been totally crushing Bitcoin in the ETF game lately.

Since 1st of July:

ETH ETF net inflows: $8.6 billion.

BTC ETF net inflows: $5.1 billion.

We finally might be having the Google blockchain soon after years of just hype and rumours and we’ll discuss its impacts here too.

And finally, we now have an all time high of Bitcoin whales, with the number of addresses holding more than 100 BTC hitting its highest number yet.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Google’s Big Blockchain Bet: What’s GCUL and Why It MattersS

It’s finally happening - Google might be heading into the web3 space after years of rumours.

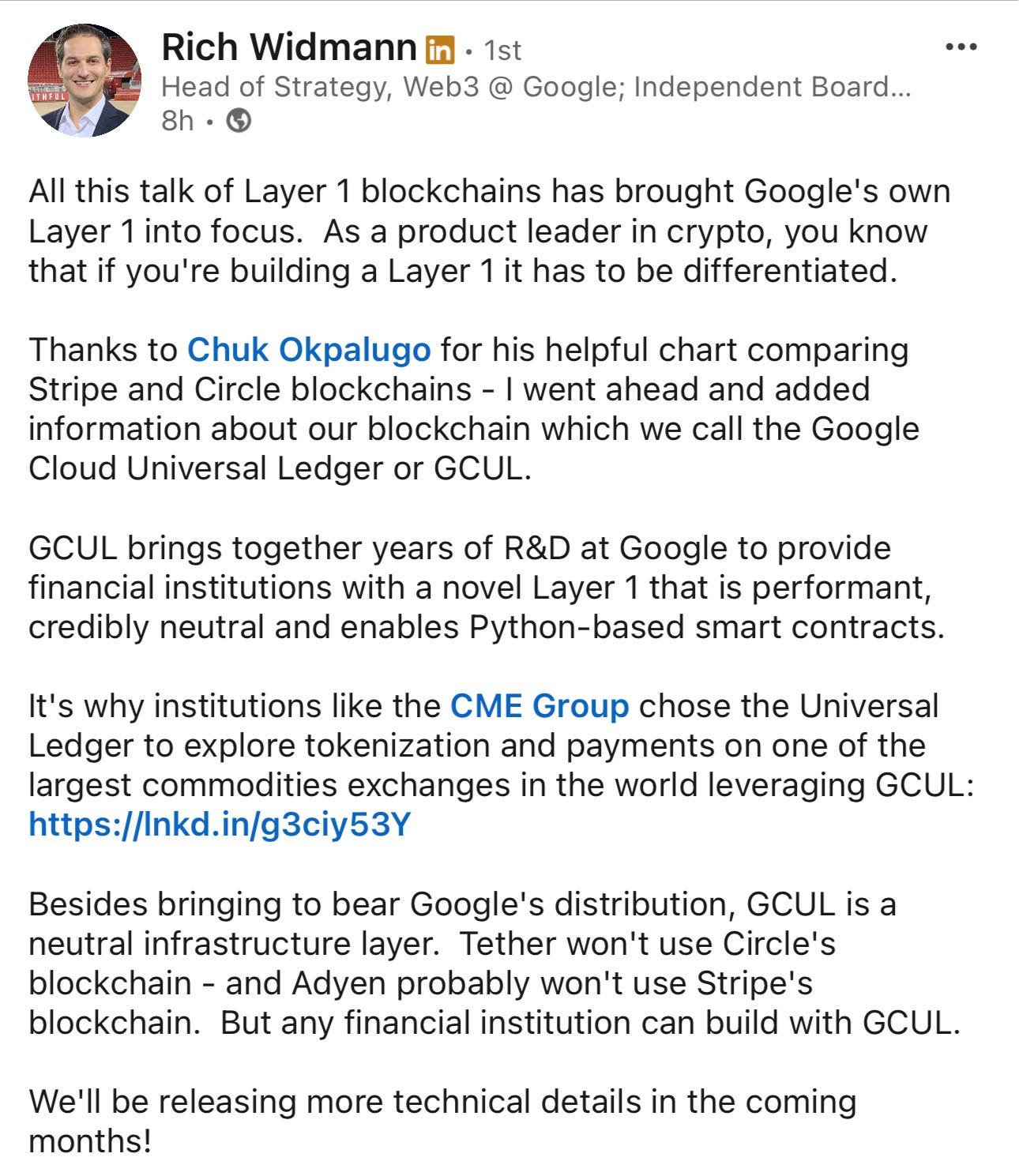

Over the past few months, quiet but meaningful signals have emerged about a secretive Google Cloud project called GCUL, short for Google Cloud Universal Ledger.

If the rumors and insider confirmations are true, this is no side experiment. It’s a full-fledged Layer-1 blockchain.

So, What Is GCUL?

According to comments from Google’s own Web3 lead, GCUL is a high-performance, “credibly neutral” blockchain built with institutions in mind. It’s designed to support smart contracts in Python, integrate smoothly with Google Cloud infrastructure, and facilitate 24/7 payments and asset transfers, especially in traditional finance.

The project first surfaced when Google Cloud partnered with the Chicago Mercantile Exchange (CME) on a blockchain pilot to improve settlement and collateral workflows. In August, Rich Widmann (head of Web3 at Google Cloud) confirmed the ledger’s name and hinted it’s already in testing with partners.

This isn’t a crypto-fueled moonshot. GCUL is aimed at banks, exchanges, and financial institutions, a “neutral” platform where rivals like Stripe, Circle, or Adyen might actually feel comfortable building.

Why Now?

It’s a smart, and maybe overdue, move. The race to build institutional blockchain infrastructure is heating up. Stripe, Circle, and Tether are all developing their own chains. Google doesn’t want to be left behind.

I don’t know how further ahead they are in their development curve but some might even say they already are behind the curve. But it’s Google, when they hit - they hit hard.

For others, the timing makes sense. The blockchain space is maturing. Stablecoins now move trillions annually. Ethereum is a settlement giant. Banks want real-time payments. Governments are warming to the idea of regulated digital money. All signs point to a future where finance runs on ledgers, not paper trails.

This is more than a tech experiment. It’s a paradigm shift. Google entering Web3 in a real way signals that blockchain is no longer fringe, it’s becoming foundational. And it could kick off a wave of similar moves by cloud giants and fintech players.

As someone who works actively in the crypto industry, I couldn’t be more excited about a proper “Web 2“ giant entering the space. Things can only get better, right?

ETH > Bitcoin ETFs (Since July)

Since the start of July 2025, Ethereum ETFs have been pulling in capital at a pace that has caught the attention of institutional investors and market analysts. While Bitcoin has long held the title of crypto’s leading asset, the recent flow data tells a different story, one where Ethereum is quickly establishing itself as a dominant force in the ETF space.

In July, Ethereum ETFs recorded $5.41 billion in net inflows. This was not just a strong month but a record-breaking one, surpassing all previous cumulative inflows since these products launched. The price pump of $ETH backed this ETF inflow rush.

That momentum carried into August. Ethereum ETFs attracted another $3.7 billion in net inflows throughout the month. In contrast, Bitcoin ETFs experienced outflows totaling $803 million. From August 21 to 27 alone, Ethereum ETFs brought in $1.83 billion, while Bitcoin ETFs gathered only $171 million. On August 27, Ethereum ETFs saw $307 million in daily inflows compared to Bitcoin’s $81 million. The next day, Ethereum added another $39 million, capping a six-day streak that totaled $1.25 billion in fresh capital.

Some reports highlighted Ethereum ETFs pulling in as much as $455 million in a single day. That is more than five times the amount attracted by Bitcoin ETFs on the same day. The data suggests institutional appetite for Ethereum is accelerating and continues to build momentum.

Several factors may be contributing to this shift but nothing more than the coveted “altseason“ which everyone in crypto (and apparently institutions too) has been waiting for.

I’m sure Bitcoin will eventually start gaining the lead again, but whilst it is not - we are in the altseason folks.

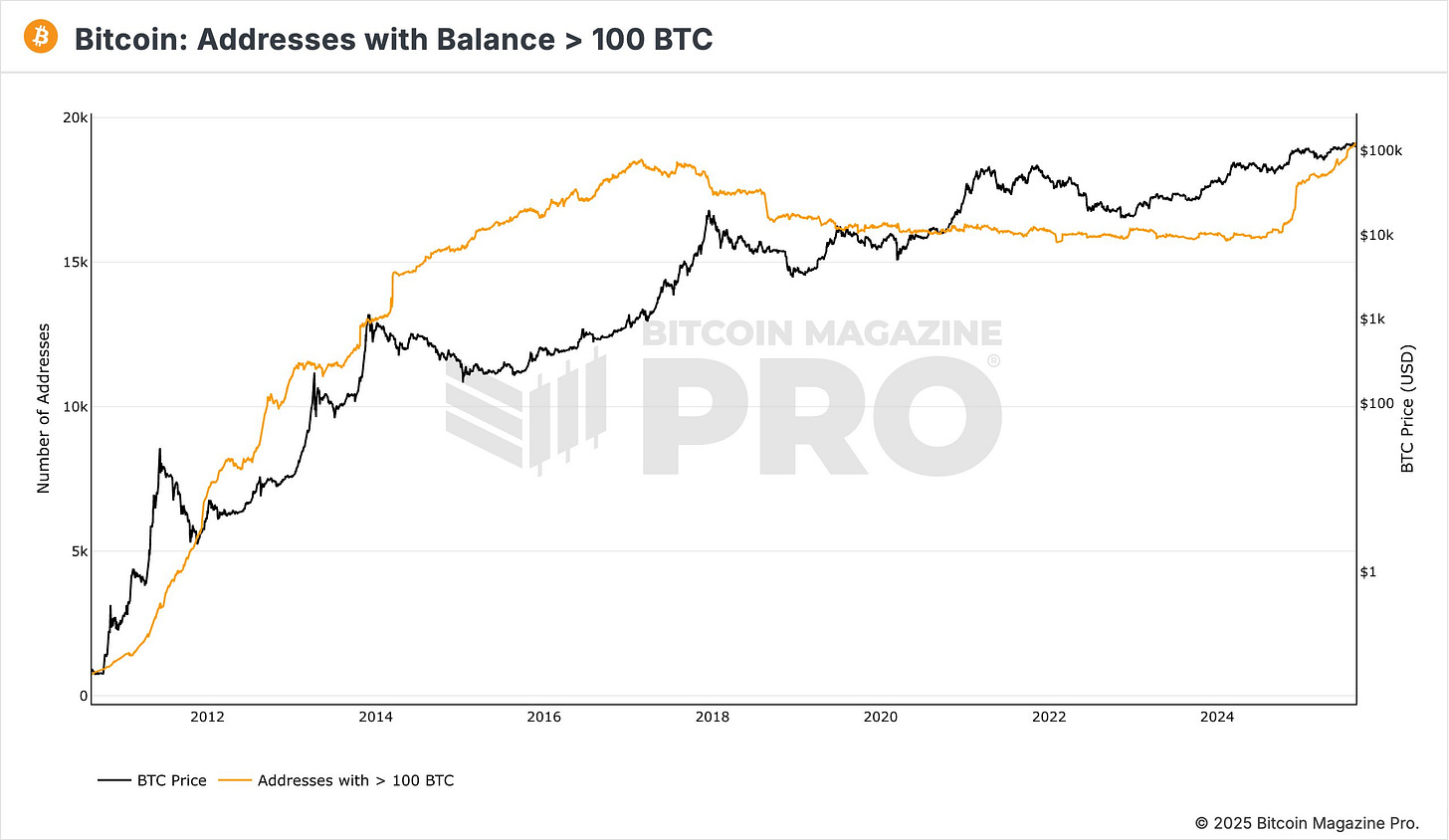

More Bitcoin Whales Than Ever

Bitcoin has reached a new milestone: the number of addresses holding more than 100 BTC has hit an all-time high. This is a key indicator that large holders, often referred to as “whales,” are continuing to accumulate Bitcoin rather than sell. In a market that remains volatile and uncertain, this trend sends a strong message about confidence in Bitcoin’s long-term value.

Several factors help explain why this is happening. First, economic instability and ongoing inflation concerns are pushing more investors toward assets that are not tied to traditional monetary systems. Bitcoin, with its fixed supply and decentralized nature, is increasingly seen as a hedge against currency debasement and central bank policy risk.

Second, the rise of regulated Bitcoin investment vehicles like spot ETFs has made it easier for institutions and high-net-worth individuals to gain exposure. Many of these large addresses likely reflect long-term holdings by funds or custodians representing multiple clients. What matters is that coins are moving into wallets that hold, not trade.

Third, the recent Bitcoin halving has once again reduced the rate of new supply entering the market. With fewer coins being mined and more being accumulated, this creates a supply dynamic that historically precedes major price increases. Savvy investors are acting early, positioning ahead of a potential bull cycle. [I wish I had been a savvy investor back in the day, but I had no money]

Anyhow, this growing number of large wallets illustrates a critical point: Bitcoin is maturing into a strategic, long-duration asset. The people and entities buying at this scale are not day-trading. They are building positions to hold for years, possibly decades, because they see Bitcoin not as a speculative asset, but as a foundational part of the future financial system.

As they say - Keep Calm and Hold Bitcoin.

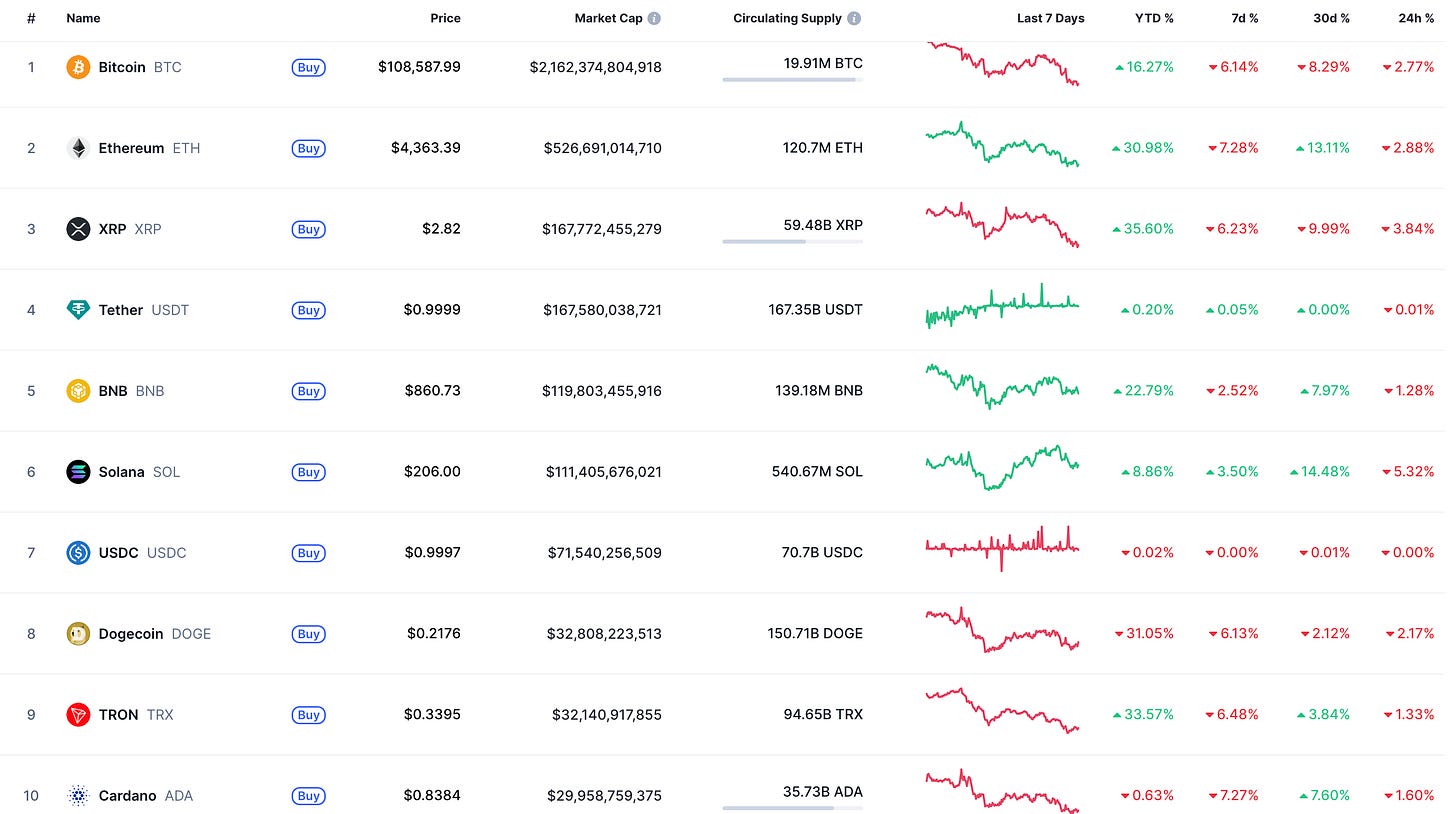

A Look At The Markets

So much good happened in crypto this week but the main thing - the market totally dumped on us. Not career shattering, but still a large crash based on what was happening in the last couple weeks.

All assets in the top 10 are in red and the TOTAL MC has dropped to $3.79T.

Biggest Winner

$CRO: After $OKB, now its another CEX coin’s turn to boom. $CRO has pumped 2x in just the last week to a $10B MC.

Crazy. Again.

Biggest Loser

$OKB: I genuinely didn’t want to do this, $OKB has been crazy good but the last week it fell, it fell 1/5th its price. But fret not, even after that - it has seen a 250% pump in the last one month.

Well, this is it for this week on HodlUp! Hopefully, next week is just as exciting and crazy in crypto and we see even more action. Till then, stay safu!