Hodl Up! Your weekly crypto catch up: Week 25 '25

Where exactly are we in the market? Will retail not show up at all? Why micro alt caps are in a bear run and we're ignoring it and why fear-greed makes no sense anymore. This week - HODL UP!

Evidence shows that we actually are in a bear market. Yes, you read that right. Just because $BTC has stayed over $100k for over 40 days (kudos to Bitcoin, btw) does not mean the market is doing well. We’ll see why I’m saying so.

Retail interest? Non-existent. Trust me, I run a social media <> media crypto company - there is no retail left anymore. We’ll back this up with data too. No false claims.

And finally we will discuss my favourite non-favourite metric to judge the market conditions, the elusive fear-greed index and why I think it makes no sense anymore.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Why We Are In A Bear (Kinda)

Just look at the chart above, I saw it on X and it’s TELLING. The chart above is the dominance (% share) of OTHERS, ie, tokens outside the top 10 crypto assets.

And if you know how to read charts, it shows that it is at it’s worst in the past 4 years. Yes, 4 years - the typical crypto cycle.

And it’s not just the percentage share that is suffering. Take a look at the absolute numbers too:

MC of OTHERS right now: $232 Billion

MC of OTHERS in Aug 2021: $232 Billion

The first thing to understand is that Bitcoin has effectively decoupled from the broader altcoin landscape. It’s no longer a reliable barometer for the entire crypto ecosystem. Institutional interest, ETF flows, and growing narrative dominance have propelled Bitcoin into its own asset class, leaving smaller coins behind.

What hasn’t helped are the macro conditions across the world in 2025. Calling it bad would be an understatement - US Tariffs, US-China Trade War and the literal war in the middle east. None have given investors enough breathing room to risk money into small caps.

Sentiment plays a huge role too. Many of the small projects are still trying to justify their existence or waiting on product launches, roadmap deliverables, or community traction. Until the next narrative wave or bull cycle triggers fresh demand, micro cap altcoins may continue to drift sideways - or lower.

Optimists? If this is the bear, that means it’s only going to get better in the bull (if your held token exists in bull that is).

Why Retail Is Not Present Right Now

Even though Bitcoin has been performing incredibly well this year, retail investors are mostly sitting on the sidelines. Here's why:

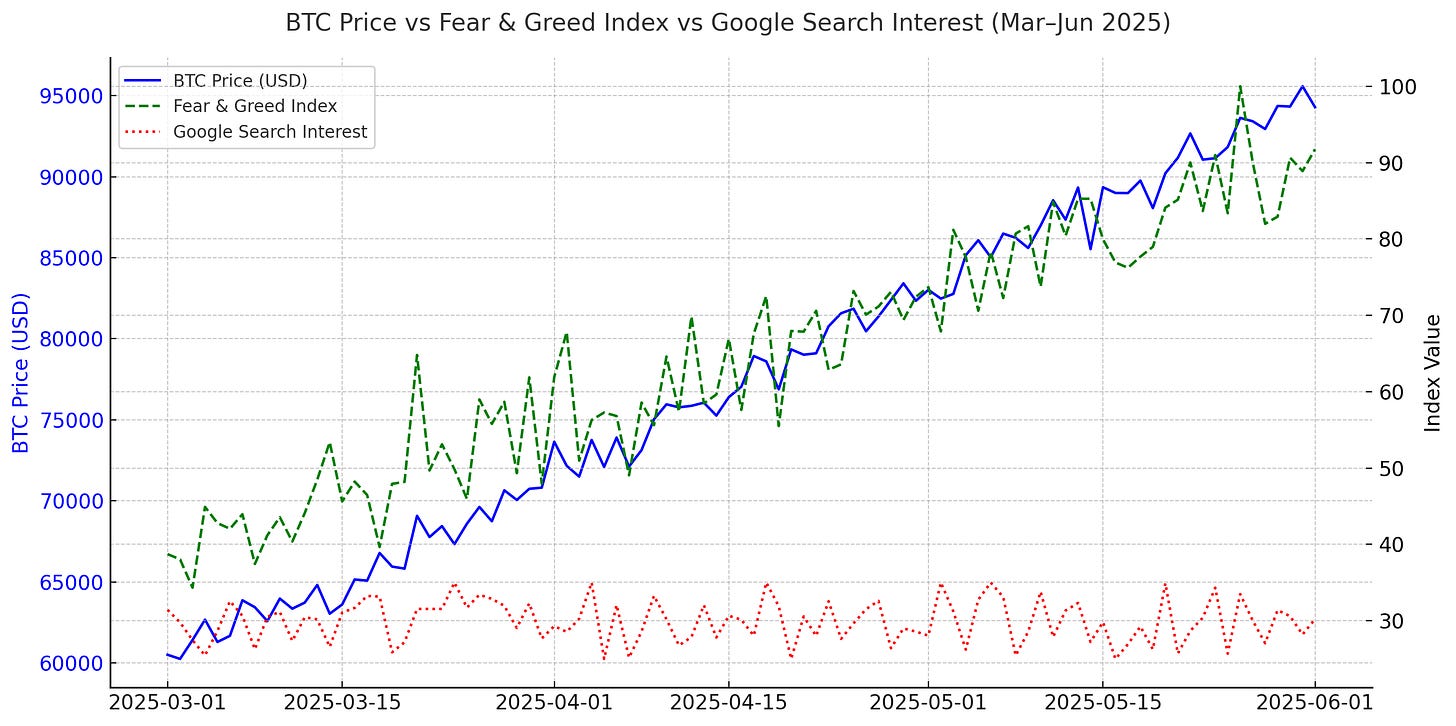

Search interest is low

Google searches for terms like “Bitcoin” and “crypto” are still near bear market levels. This is a strong signal that the general public isn’t paying attention, even while prices are climbing. The current levels are akin to that of the 2022 bear market.App store rankings are way down

During past bull runs, apps like Coinbase and Binance were consistently in the top 10 finance apps—and often cracked the top charts overall. Today, they’re well outside the top 100 in many countries. That means fewer new users are downloading them.Retail isn’t buying, institutions are

Data shows that most of the buying this year has come from institutions, not retail traders. In some cases, retail investors have actually been net sellers, using the rally as an exit opportunity rather than buying in.No real “buzz” in mainstream culture

Unlike in 2021, crypto isn’t part of everyday conversation right now. Celebrities aren’t tweeting about it, and there’s no surge of viral NFT drops or new DeFi trends pulling people in. This is a huge one if you remember how hot was Bitcoin and Doge in 2021.Crypto apps aren’t seeing much new user growth

Platforms like Coinbase and Binance already have large user bases, but growth has slowed. If retail interest was really returning, we’d be seeing a spike in new account signups. We’re not.

The bottom line: Retail investors just aren’t back yet. They’re not searching, they’re not downloading apps, and they’re not buying. This rally, so far, belongs mostly to institutions and existing crypto users. Until retail starts showing signs of life, it's hard to say we're in a true bull market for the broader space.

And guess what? Institutions don’t buy micro caps, hence the section above.

Saw this on X , not sure if its true or not though (haven’t cross checked):

Fear-Greed = Not For Me Anymore

The Crypto Fear & Greed Index used to be a pretty solid pulse check for sentiment. Back in the 2017 and 2021 cycles, it often lined up with reality, you could feel the euphoria when it screamed “Greed,” and the panic when it hit “Fear.” But lately? It feels disconnected from what’s actually happening on the ground.

Here’s why I’ve stopped putting much weight on it:

It reflects price more than psychology

These days, the index mostly moves with Bitcoin’s price. If BTC is up 5%, it shifts toward “Greed.” If BTC drops, it ticks toward “Fear.” That might sound logical, but it misses the nuance. Just because prices are higher doesn’t mean people are excited or confident. Right now, we’re seeing high prices with low retail involvement—hardly a greedy environment.Retail isn’t participating

One of the biggest problems with the index today is that it doesn’t account for the absence of retail sentiment. You can’t measure “greed” in the market when the majority of casual investors are still on the sidelines. If anything, the market feels cautious, even hesitant, not euphoric.It doesn’t reflect altcoin conditions

The index is heavily influenced by Bitcoin, but most of the crypto market- especially altcoins and micro caps, is in a clear bear trend. If you're holding anything outside the top 10, "Extreme Greed" probably feels like a joke. The index gives a false sense of strength if you're not exclusively in BTC.Too simple for today’s market

The market has matured. It’s not just BTC and hype anymore, it’s ETFs, institutions, macro trends, regulatory headwinds, and fragmented narratives. One number can't capture all that complexity.

In short: The Fear & Greed Index has become more of a lagging indicator tied to price than a meaningful read on real sentiment. It’s still fun to glance at, but if you’re using it to time entries or exits, it’s probably giving you the wrong signals.

A Look At The Markets

I think as the conflict in the middle-east is stretching, financial markets are suffering more and more. The $TOTAL cryto MC lost another $70B this week to end up at $3.21B at the time of writing. Even Bitcoin seems to be in a danger of dropping below $100k after nearly 1.5 months.

Biggest Winner

$SEI: Hands down the winner this week is $SEI, a billion+ project pumping nearly 25%. The positive sentiment is there to be seen all over socials as well. Great work $SEI.

(Major Reason: SEI was officially shortlisted by Wyoming’s Stable Token Commission as a candidate blockchain to host WYST, the state's first fiat-backed stablecoin.)

Biggest Loser

$SPX6900: I’ll give it a break. It has been winning for the past two weeks and just dropped 16% yesterday, a pullback had to happen and it happened.

Well, that is it for this week and oh yes, everyone please change your passwords on your accounts since there has been a huge leak of passwords on the internet and of course I want you all to be SAFU.