Hodl Up! Your weekly crypto catch up: Week 21 '25

Another Bitcoin high before being pulled back, Coinbase data breach causes a huge issue but a smaller issue than SUI's Cetus protocol hack. A lot in this week's HODL UP!

Talk about a busy week - the crypto industry could not have seen a more disruptive week all over. Bitcoin crossed the ATH and took it even over $111,000 before the pullback yesterday but it really does not seem like stopping. Why?

Companies and institutions all over the world have been accumulating Bitcoin like never before - companies ranging from Brazil to the Scandinavia, from the far east to the middle east. Are companies the new retail for Bitcoin?

And again, as it happens in crypto - the good with the bad. Coinbase faced a huge data breach which caused massive losses to certain users, the keyword being “certain“ because on Thursday evening SUI’s LP Cetus Protocol faced a hack of nearly $200M that affected, well, all users and tokens on the SUI ecosystem.

We’ll discuss all these things on this week’s HODL UP and look whether the market is good for a “dip“ right now.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Organizations - The New Retail

I think most of the veterans in the space will agree with me when I say - there’s no retail in yet. Yes, Bitcoin crossed $111,000 but there’s no interest from the common man - that is the truth. You don’t see your Uber driver talking about Bitcoin, you don’t see your family members getting scammed in crypto (yes, that did happen in 2021).

The price is going up, by quite a lot still. How is that happening? That is all happening due to institutional investment. Companies have been stacking up Bitcoin, we already know of ETFs in multiple countries. The US Bitcoin ETF is the most successful ETF ever - more successful than Gold. So yes, I am confident in saying that organizations are the new retail in 2024-2025.

Let us see some of the companies that are knee deep into Bitcoin (some are neck deep, yes you - Strategy):

Strategy (USA): Formerly known as MicroStrategy, Strategy is the largest corporate holder of Bitcoin, with over 576,000 BTC in its reserves. The company has become a benchmark for Bitcoin adoption among institutions.

Metaplanet (Japan): Based in Tokyo, Metaplanet has rapidly built a significant Bitcoin treasury, holding around 7,800 BTC. It stands as Asia’s leading publicly traded company in terms of Bitcoin reserves.

H100 Group (Sweden): In 2025, H100 became Sweden’s first public company to hold Bitcoin in its treasury, starting with a purchase of just over 4 BTC.

The Blockchain Group (France): Listed on Euronext Paris, this tech firm holds nearly 850 BTC and has secured funding to expand its Bitcoin strategy.

Méliuz (Brazil): Brazilian fintech Méliuz now holds over 270 BTC, becoming the first public company in Brazil to formally adopt a Bitcoin reserve strategy.

I think this will continue to increase - with regulations all over the world becoming clearer and Bitcoin proving to be a great hedge against inflation again and again. I believe Bitcoin will join the “Gold“ class very soon.

Coinbase User Data - Breached

In May 2025, Coinbase - yes, that Coinbase, the one I’ve been praising for weeks, took a tumble into the cybersecurity hall of shame. It wasn’t a flashy Hollywood-style hack with blinking red terminals and evil laughter. No, this one was more like a heist pulled off with a clipboard and a confident smile. Turns out, some crafty cybercriminals sweet-talked (and allegedly bribed) a few overseas customer service agents into handing over user data like it was free candy.

The breach affected roughly 70,000 users, with data including names, phone numbers, addresses, government ID photos, and even partial Social Security numbers. While no funds were directly stolen (yet), the real treasure for these cyber pirates was information—perfect for launching sneaky phishing attacks. Some users reported receiving ultra-convincing fake emails that could’ve fooled even the most hardened crypto veteran.

Coinbase’s response? They channeled their inner cowboy, refused to pay the $20 million ransom, and instead slapped a $20 million bounty on the heads of the hackers. That’s right, full Wild West justice, just with more encryption and fewer tumbleweeds.

But behind the comedy of digital errors lies a serious wake-up call. In crypto, security is not just a checkbox - it’s a lifestyle. This breach cost Coinbase potentially hundreds of millions in damage control, but for users, the cost could be a lot more personal. Identity theft, phishing, and impersonation scams are just the beginning when your data’s out in the wild.

So, dear cryptonauts, consider this your friendly reminder: turn on two-factor authentication, never trust a random text saying your “wallet is in danger,” and maybe, just maybe, don’t keep your entire net worth in one place named after a coin.

The blockchain may be immutable, but your attention to security better be flexible and always up to date.

The Cetus Hack And Is There Any Decentralized Chain At All?

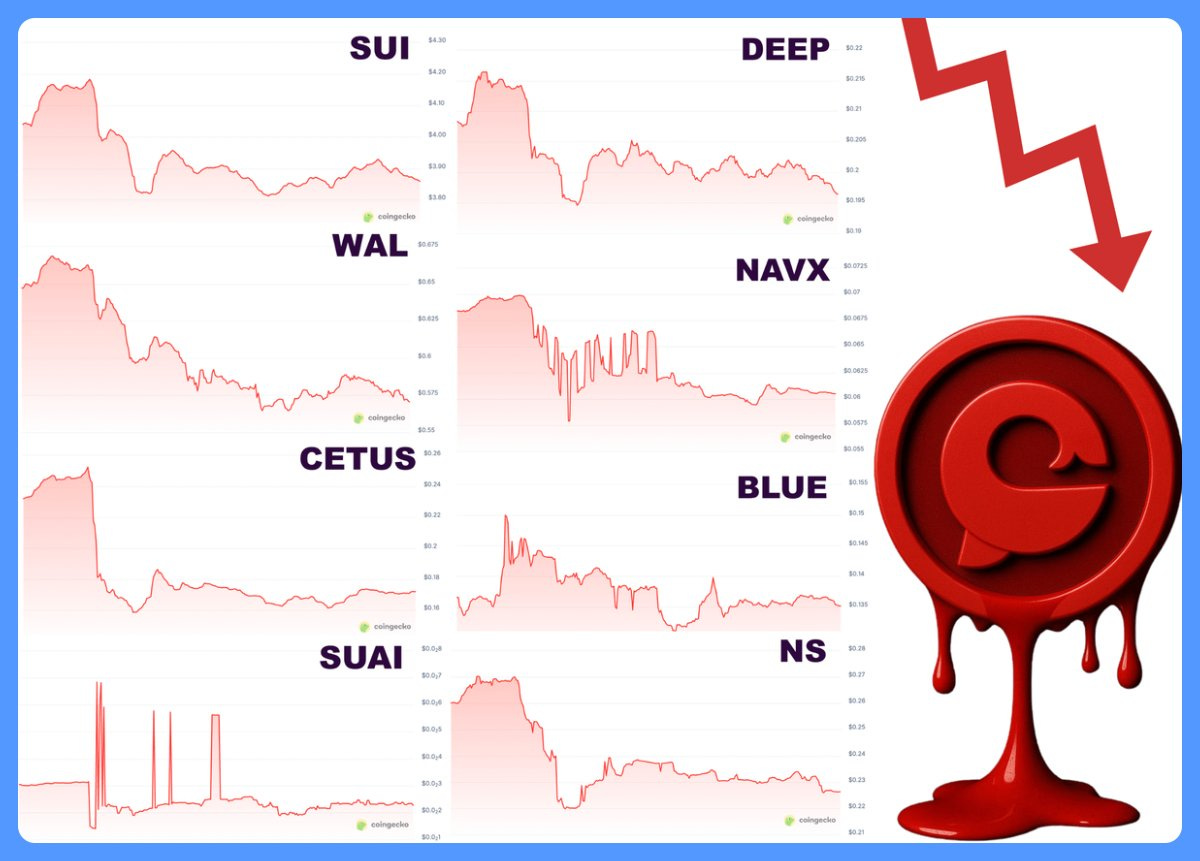

In a devastating blow to the Sui blockchain, Cetus Protocol—the network’s flagship DEX—was rocked by a catastrophic oracle bug on May 22, 2025, resulting in a $223 million loss. At first thought to be a hack, the team later clarified it was due to a fatal flaw in the oracle price feed, not an external breach. Still, for users watching their assets vanish in real-time, the distinction was about as comforting as “Oops” written in all caps.

The exploit allowed attackers to manipulate token prices within liquidity pools. Once the door was open, they marched through, draining millions in USDC, swapping it to ETH, and laundering it through Tornado Cash faster than you can say “rug pull.” The SUI/USDC pool alone lost $11 million. Memecoins like MOJO and BULLA were hit even harder, dropping over 90% in value. For a while, even USDC looked nervous.

Cetus, supported by the Sui Foundation and validators, sprang into action and managed to freeze $162 million of the stolen funds. But here’s where things got philosophical- and a little spicy. In a move straight out of the “Emergency Centralization Toolkit,” Sui validators collectively blocked transactions from addresses tied to the exploit. That froze funds, yes, but also ignited a firestorm of debate.

Some called it necessary, a life-saving maneuver. Others saw it as a betrayal of decentralization. After all, if a validator set can effectively blacklist wallets at will, what separates Sui from a glorified PayPal?

And the community? Torn. Think DAO fork vibes circa 2016, but this time there was no vote—just swift action. Some praised the network’s agility. Others demanded answers, transparency, and wondered aloud whether the attacker had inside help.

One thing is clear: Cetus Protocol now faces not just a technical rebuild, but a trust deficit. The Sui ecosystem must confront hard truths about security, decentralization, and how to handle billion-dollar mistakes in a decentralized world.

Src: Our Crypto Talk, X

A Look At The Markets

Okay, so the numbers today are underwhelming given what has happened over the past week. The TOTAL MC has pumped from $3.27T to $3.39T but it was at a a massive $3.52T on Friday before the pullback.

The EU Tariff news along with some news surrounding no progress in the US-China trade deal has pulled back TradFi and Crypto markets a bit but before that, it was very gung-ho. Especially Bitcoin, which made yet another ATH.

Biggest Winner

$BTC: You can’t, you can’t win against Bitcoin if it pumps 8% in a week. Your coin might have done a 20x that week but Bitcoin will still win, okay?

Biggest Loser

$PYTH: I feel like I’m being harsh here because alts haven’t had a lot of room to work with but $PYTH, sorry man - a 13% dump this week, along with a 10% dump overall in 30d, you’re the loser of the week.

Well, that is all for this week guys but with the news coming already, the coming week seems to be just as exciting as the previous one - fingers crossed on Ethereum doing some magic, finally. Will meet you next week, till then, STAY SAFU.