Hodl Up! Your weekly crypto catch up: Week 19 '25

Are we finally into the promised land of the bulls? Has the Ethereum upgrade sparked this or is it just macro? And what about the United Kingdom mate, will they finally adopt crypto?

What a great week has it been for the cryto market - We’ve seen $BTC easily cross $100k ($104k in fact) and even the sleeping giant (don’t 👀 me, I always rated Ethereum) $ETH cross $2,500. Are we finally into the best part of the cycle and how will alts behave after this?

Ethereum had its biggest upgrade in quite a while but to be honest, that did lesser to convince the markets than the macro decisions all over the world, especially in the USA but we will look at what this means for Ethereum going into the future.

And finally, there has been a lot of talk around crypto and digital assets in the United Kingdom lately, so we’ll take a little tour of the King’s land and their relationship with crypto over the years.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Market’s Galore, Finally

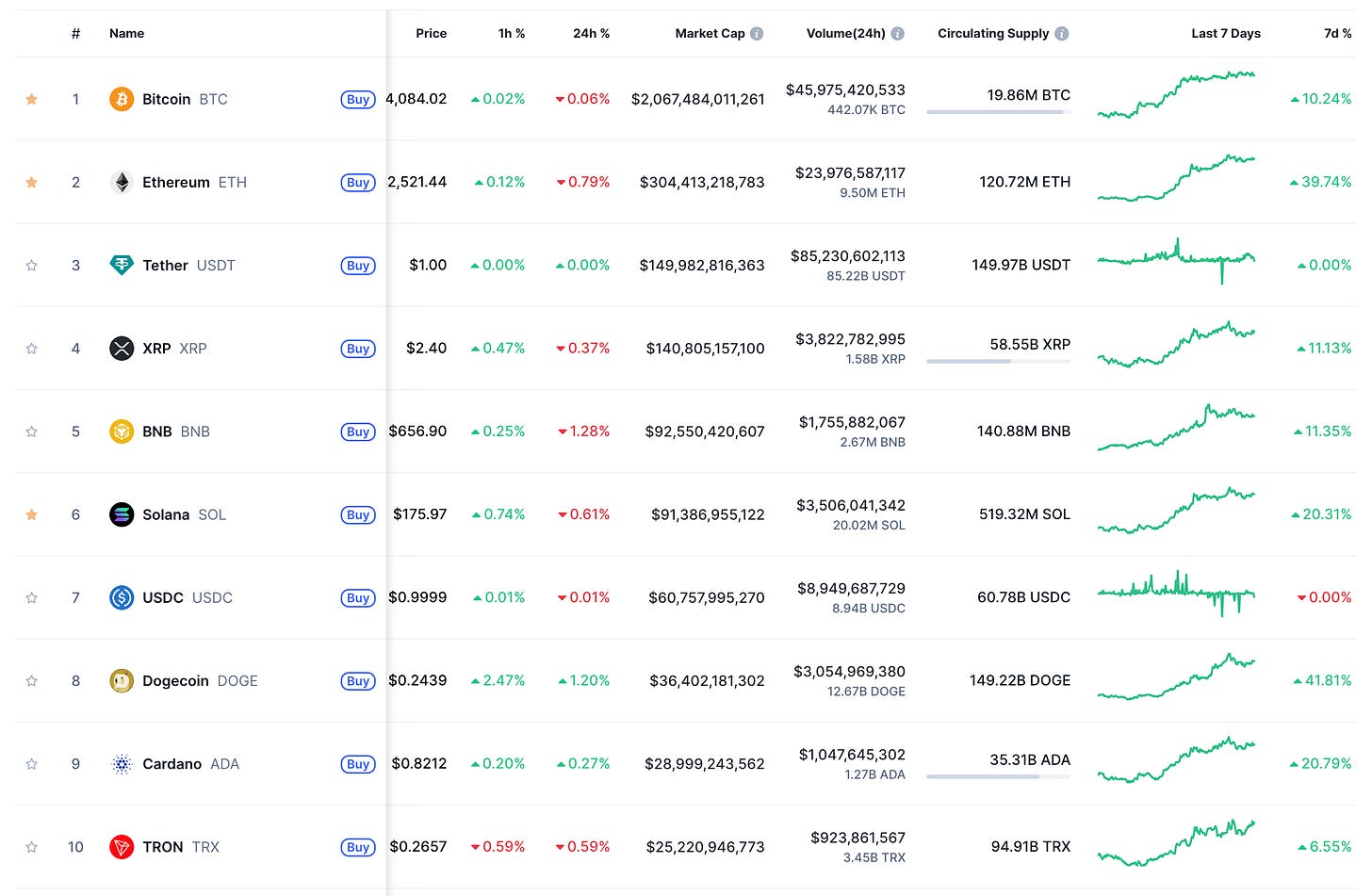

It had been a long long time since we saw a very strong week in the crypto space and we finally saw it this week. The total MC increased by an astounding $330B and we saw Bitcoin’s dominance fall after a very long time, despite Bitcoin hitting $104k.

What makes me even more optimistic about this week’s pump is the fact that Ethereum is finally showing some decent movement. I have always been of the belief that to get a proper altseason, we need $ETH to do well. My definition of “well“ has changed a lot in this regard, with it starting from a new all time high and going all the way to - “Please hit $3,000 Ethereum“ but you get my point.

Now, I maybe completely wrong and we might see an altseason with $ETH stuck at $2,500 but again, this is just my opinion. 🤷

When Bitcoin dominance drops, it’s usually a good sign for altcoins. Think of it like this: if less money is focused on Bitcoin, it’s flowing into other cryptocurrencies, this is where altseason kicks in. Historically, when BTC.D falls below key levels (like 45% or 40%), altcoins tend to surge as people start betting on bigger gains outside of Bitcoin.

The Altcoin Season Index, which measures the performance of altcoins relative to Bitcoin, has climbed from 23 to 36 in early May . While still below the threshold of 75 that typically signals a full-fledged altseason, this increase points to a positive shift in sentiment toward altcoins.

I’d say - keep your fingers crossed for an altseason to come in the coming month or so, but don’t pin your hopes on an easy 100x on every project you’re into.

Britannia on the Blockchain: The UK and Crypto

When you think of the United Kingdom, you might picture Big Ben and a nice cup of tea – not Bitcoin or blockchains. Yet over the past decade, the UK’s relationship with digital assets has evolved from wary skepticism to active curiosity. Here’s how Britain went from treating crypto like an unruly stranger to eyeing a future as a global crypto hub.

In Bitcoin’s early days, UK regulators largely watched from the sidelines. As the market grew, that British caution kicked in. A turning point came in 2018 when the government formed a Cryptoassets Taskforce – bringing together the Treasury, Bank of England, and Financial Conduct Authority (FCA) to explore the nascent crypto sector. This marked the first serious effort to regulate digital assets. Soon after, the UK brought crypto exchanges under anti-money laundering rules, requiring them to register with the FCA. Officials even warned investors to be prepared to “lose all their money” in crypto – a stern caveat emptor as Britain dipped its toes into digital currency.

By 2020, the UK got tougher on crypto. The FCA banned crypto derivatives for retail investors, deeming them too risky, and in 2021, the advertising watchdog gave Arsenal FC’s fan-token promotion a red card for being misleading. Regulators even warned Binance – one of the world’s largest exchanges – that it was not authorized to operate in the UK.

Yet amid the crackdowns, the UK also began warming to crypto’s potential. In 2022, then-Chancellor Rishi Sunak unveiled plans to make Britain a “global hub” for crypto technology. The government even asked the Royal Mint to craft an official NFT as an emblem of this forward-looking approach. (Yes, an "NFT for Britain"!) While that idea was later shelved, it underscored an intent to keep up with crypto innovation. By 2023, crypto was no longer niche – about 12% of UK adults owned digital assets, up from just 4% in 2021, reflecting growing public interest.

The Latest Chapter: 2024–2025

Fast forward to late 2024, and a new government brought fresh resolve to roll out crypto rules. In November 2024, Treasury minister Tulip Siddiq confirmed that the full regulatory framework proposed in 2023 would be implemented. An earlier plan to regulate in two stages (stablecoins first) was scrapped in favor of doing everything at once. She also noted the rules would clarify gray areas (like how crypto staking services are classified) to avoid stifling innovation.

Meanwhile, the UK is doubling down on innovation. It opened a Digital Securities Sandbox in 2023 to let firms experiment with blockchain in financial markets. The government even plans to issue a blockchain-based government bond (nicknamed "DIGIT") as a pilot. It’s a careful balancing act between prudence and tech optimism – or as Siddiq put it, the UK intends to “lead the world in digital assets adoption,” a bold claim that grabbed plenty of attention.

The UK’s crypto journey matters beyond its shores. London’s status as a financial hub means a well-calibrated UK crypto regime could inspire other countries and attract companies tired of crackdowns elsewhere. If Britain proves it can protect consumers and welcome innovation, it might give the global crypto market a much-needed boost in credibility and momentum. In short, the UK has a chance to set global standards – and everyone from Wall Street to Web3 will be watching to see if this experiment pays off.

Ethereum Pectra: Launch and Aftermath

Most of this information is from ChatGPT since I’m not that technical a person but I felt it is my duty to include this since I am an Ethereum person.

On May 7, 2025, Ethereum rolled out its much-anticipated Pectra upgrade, and to say it made waves would be an understatement. Combining two major updates—Prague for the execution layer and Electra for the consensus layer, Pectra brought a fresh set of tools to the Ethereum ecosystem. With 11 new Ethereum Improvement Proposals (EIPs) packed in, it’s like Ethereum got a full software makeover.

One of the big highlights is Account Abstraction (EIP-7702). Think of it as turning regular Ethereum accounts into mini-smart contracts, even if just temporarily. This means features like gas fee sponsorship and batch transactions are now possible without the headaches. For users, it’s like upgrading from a bicycle to an electric scooter - same idea, way smoother ride.

Then there’s Increased Staking Cap (EIP-7251). Before Pectra, if you wanted to stake a serious chunk of Ethereum, you’d have to juggle multiple validators, each capped at 32 ETH. Now? That cap has been bumped up to a whopping 2,048 ETH. It’s like going from fitting your luggage in a Mini Cooper to tossing it all in the back of a Range Rover. Big players can finally move around with less hassle.

Pectra didn’t stop there. It also rolled out Enhanced Layer 2 Scalability (EIP-7594). Ethereum introduced something called Peer Data Availability Sampling (PeerDAS), which essentially makes Layer 2 transactions faster and cheaper. If you’ve ever groaned at Ethereum gas fees, this is the update you’ve been waiting for.

Well, Ethereum’s price shot up almost immediately after Pectra went live. Within two days, ETH was up 40%, cruising past $2,400. Investors clearly liked what they saw, and the buzz around Ethereum’s potential got even louder. It’s like the network got a turbo boost, and everyone wanted in on the ride.

But it’s not just about the price spike. Pectra laid the groundwork for Ethereum’s next big thing - Fusaka, another upgrade aimed at pushing scalability even further. If Pectra is the appetizer, Fusaka is set to be the main course.

For now, Ethereum looks stronger than ever, and Pectra seems to have set the stage for even bigger things. The blockchain is evolving, and with updates like this, it’s clear Ethereum plans to stay at the forefront of the crypto world.

A Look At The Markets

The total market cap sits at $3.33T at the time of writing with Bitcoin at $104,122. Even $ETH is sitting at a comfortable $2,540 and things are looking bright going into the new week. If the TOTAL market cap hits $3.50T this week, we can call it a win.

Biggest Winner

$MOODENG: I won’t tell you - just go on Coinmarketcap/Coingecko or wherever and see what it’s done in 7 days.

Biggest Loser

NO LOSER THIS WEEK, WE’LL DECLARE EVERYONE A WINNER.

This is it for this week guys, I def have my fingers crossed going into the new week. As I said, this might be a very crucial week for micro-mid cap altcoins and we might see a huge pump this week but NFA. Stay Safu!