Hodl Up! Your weekly crypto catch up: Week 2 '25

A very happy first Birthday to Bitcoin ETF, will the US govt sell any of its BTC before Trump takes office and how companies like MicroStrategy and Metaplanet have built their entire brand around BTC.

If we talk about the biggest catalyst in $BTC hitting $100k - some will mention Donald Trump, some the halving but I will definitely credit that the most to the spot Bitcoin ETF, which celebrated its first birthday on 10th January 2025.

The markets continue to be boring, leaning towards the side of fear a bit but the most optimistic of fellas are … well ‘optimistic‘.

With the United States DOJ having been cleared to sell the Silk Road $BTC, will they do it? Everything we discuss in this week’s HodlUp!

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Bitcoin Spot ETF: 10 Jan 2024 - Immortal

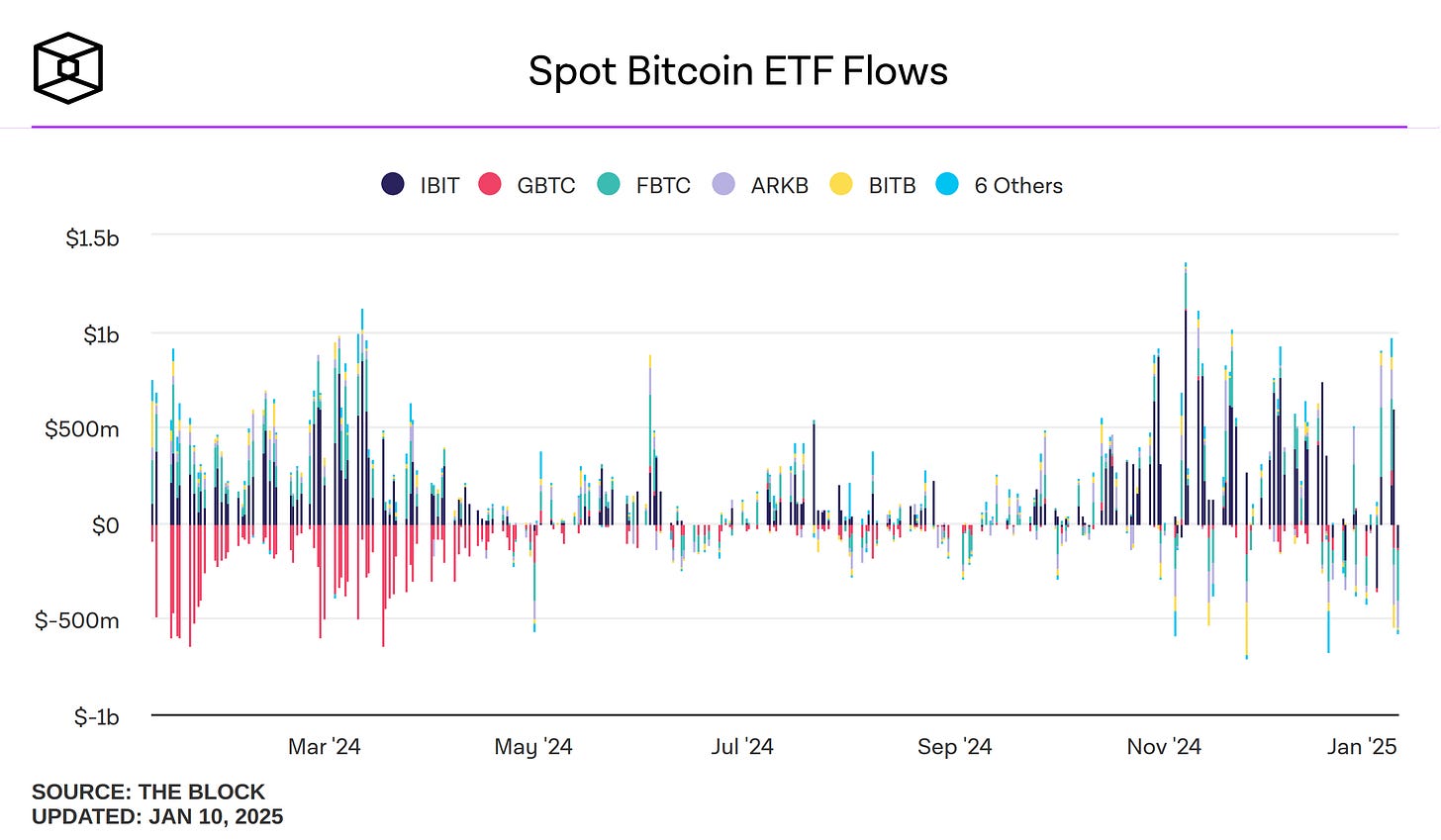

It’s been just a year since spot Bitcoin ETFs were launched in the United States, and let me tell you, they’ve already reshaped the financial landscape. January 10, 2024, will forever be marked as the day crypto finally hit Wall Street in style. The SEC’s approval opened the floodgates, and what followed exceeded even the wildest expectations.

By the end of 2024, these ETFs had pulled in a jaw-dropping $44.2 billion—yep, all from Bitcoin products. To put that into perspective, this isn’t just a crypto milestone; it’s a financial market breakthrough.

BlackRock’s iShares Bitcoin Trust ETF led the charge, with a staggering $61 billion in assets under management (AUM) within a year. For context, its gold ETF took 20 years to reach a humble $33 billion. Bitcoin is here to prove that while gold is shiny, it’s not nearly as fast.

It wasn’t just BlackRock soaking up the limelight. The entire ETF ecosystem proved there’s massive institutional demand for crypto exposure without the hassle of self-custody or private keys. As someone who’s been around crypto for years, seeing this kind of mainstream adoption feels like witnessing history in real-time.

As someone who’s been following Bitcoin’s journey since its nerdy forum days, this ETF success feels almost poetic. For years, we’ve heard critics say, “It’s not real,” or “Institutions will never touch it.” Well, here we are, with Bitcoin ETFs smashing records and leaving traditional assets in the dust.

Companies Building Around The BTC Brand

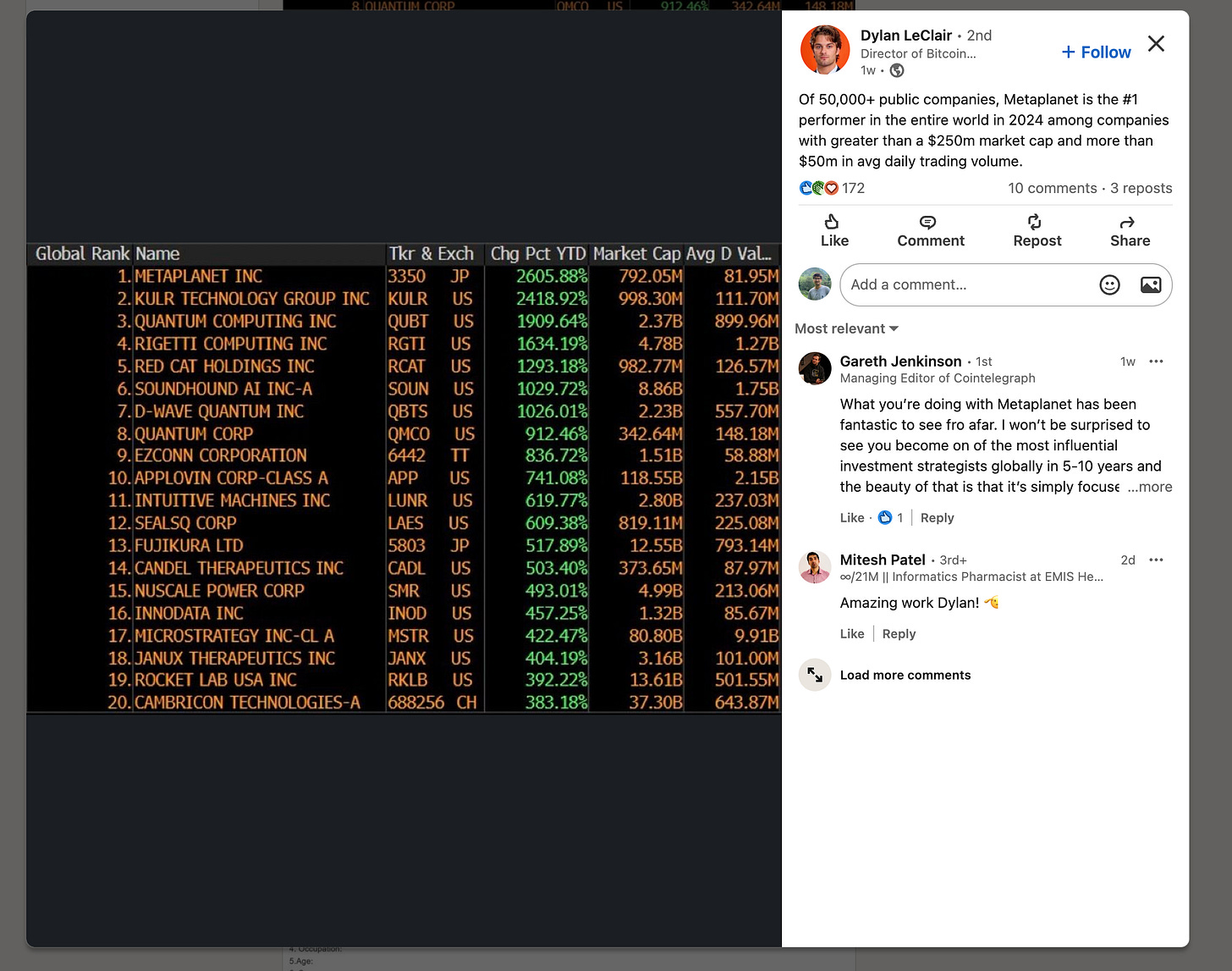

Bitcoin has been used by companies to define their entire brands. Two standout examples, MicroStrategy and Metaplanet, have ridden the Bitcoin wave to fame, fortune, and sometimes a touch of skepticism.

MicroStrategy, led by Michael Saylor, is practically synonymous with Bitcoin. Since 2020, the company has poured billions into Bitcoin, holding over 150,000 BTC at last count. The strategy? Simple: Bitcoin is digital gold, and they’re stacking it like Fort Knox 2.0. The gamble has turned MicroStrategy into a Bitcoin proxy stock, making it a favorite among crypto enthusiasts. The upside? Their holdings have appreciated significantly, and their brand is now etched into Bitcoin folklore.

Metaplanet, a quieter but equally focused player, has built its name entirely on Bitcoin investments. By positioning itself as a pure Bitcoin play, the company has attracted investors who see Bitcoin as the future of finance. Its strategy highlights the power of niche branding in the crypto space.

But let’s not sugarcoat it—this approach comes with risks. Tying your corporate identity to a volatile asset is like putting all your eggs in one very jumpy basket. Bitcoin’s price swings can make or break quarterly earnings, spook shareholders, and even overshadow core business operations. Critics argue that these companies are riding a speculative bubble rather than creating intrinsic value.

That said, the pros are undeniable. These companies have cemented themselves as Bitcoin leaders, gaining loyal followings and attracting investors who believe in the long-term vision of decentralized money.

For now, companies like MicroStrategy and Metaplanet are thriving on their Bitcoin bets. But when we ask the question - “What else do MicroStrategy and Metaplant other than invest in BTC”, not many have the answer.

The Silk Road Bitcoin - Keep or Sell ?

In a dramatic twist to the U.S. Department of Justice’s (DOJ) $6.5 billion Bitcoin liquidation plan, time is running out before a major political shift. With President-elect Donald Trump set to assume office in just 10 days, questions loom over whether the current administration will pull the plug on the sale before handing over the reins.

Trump has been vocal about his stance on government-held Bitcoin, promising not to sell it. His administration has hinted at holding seized crypto assets as part of a broader strategy to embrace blockchain and digital currencies. This bold position raises the stakes for the DOJ, which recently received court approval to liquidate 69,370 Bitcoin seized from the Silk Road marketplace.

Chief U.S. District Judge Richard Seeborg cleared the liquidation on December 30, 2024, ending years of legal battles over the assets. The Bitcoin, traced to the elusive hacker “Individual X,” mark one of the largest cryptocurrency liquidations in history. Yet, the timing of this decision couldn’t be more contentious.

The U.S. Marshals Service, tasked with managing the sale, has the expertise to execute large-scale liquidations. However, selling over $6 billion worth of Bitcoin quickly could disrupt the market. Institutions might absorb the supply better than in the past, but fears of volatility persist.

Adding urgency is Trump’s promise to pivot U.S. crypto policy. His administration’s approach could involve holding Bitcoin as a strategic reserve, a move that contrasts sharply with the current government’s liquidation plans.

So, will the DOJ rush the sale in its final days, or will it defer to the incoming administration’s preferences? The answer will set a precedent for how governments handle seized digital assets in a politically charged environment.

A Look At The Markets

Oh well, they suck. Yes, wrapped up in two words. For the numbers guys - the total MC sits at $3.28T and Bitcoin is floating around $93k at the time of writing. Fingers crossed for the day Trump takes office though.

Biggest Winner

$CGPT : Tbh, there are no real winners this week. CGPT benefitted from the Binance listing, pumping 65% but had a very tough week before that. 15% up on the week is decent though.

Biggest Loser

$RUNE : RUNE had a bad week too, actually all altcoins did but RUNE had a particularly bad one - with a drop of 35% in its price.

C4 (Crazy Crypto Community Content)

Content 1

This uber taking spiderman had a point beyond the comprehension of a normal person. That’s what thinking in layers is all about.

Oh btw, our sincerest condolences to Mr. Howells.

Content 2

Okay so this is not a crypto content but is definitely crazy - what? I did not know the stock markets stopped for political reasons. Maybe we in the crypto world are just too used to 24*7 nature of the system.

Well, that is it for this week folks. Hopefully we have a better market going into the next week and fingers crossed on the US govt not selling off their Bitcoin as of now! STAY SAFU