Hodl Up! Your weekly crypto catch up: Week 12 '25

Eric Trump - Good or Evil for the industry? What about CZ? Has CZ turned 'heel' and we do not realise it? And a discussion on why most crypto communities are just bots or people in Bangladesh.

This week was relatively much quieter in the crypto space and that means I have enough time to question two of the richest men on the planet because - why not? I’ll be giving my personal views on Eric Trump (no relation to Donald, really, trust me, okay, his son) and our very own - Changpeng Zhao.

And I’ll also touch on a topic that is quite close to me, not emotionally but in terms of my work - the number of bots in crypto project communities. This number has actually become so huge, its become a problem.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Eric Trump - Good or bad?

Just my two cents -

Eric Trump has stepped into the crypto space with more energy than his father, showing a genuine interest in the industry's future. While Donald Trump views crypto as another campaign promise to fulfill, Eric appears to see real potential. His involvement with World Liberty Financial (WLFI)—a DeFi project launched under the Trump family's name—demonstrates this enthusiasm. But does that make him good for crypto? The answer isn't simple.

Eric Trump is much more outspoken than Donald when it comes to crypto. He actively discusses digital assets, market trends, and blockchain's role in reshaping finance. Unlike his father, whose support for crypto seems transactional, Eric appears to actually care about the industry's direction. His willingness to engage with the community, make investments, and push for innovation suggests that he sees crypto as more than just a political tool.

The Trump family's influence is a double-edged sword. On the one hand, having a powerful political family advocate for crypto could help push regulation in a favorable direction. On the other hand, their involvement adds an element of unpredictability. If their policies or investments take a wrong turn, it could hurt market sentiment. **cough cough, they already have**

For example, World Liberty Financial has already invested $336 million in crypto but is sitting on an $88 million floating loss. That level of volatility raises concerns. Are they making strategic moves, or just making noise? If Eric wants to lead crypto forward, he needs to provide more than bullish soundbites—he needs well-thought-out mechanisms.

Eric, along with Donald Trump Jr. and even 18-year-old Barron Trump, launched World Liberty Financial in September 2024. The project aims to move away from traditional banking, but details remain scarce. While the idea sounds promising, launching a DeFi platform successfully requires deep expertise, regulatory navigation, and trust-building. The question is: Does Eric have the experience to execute such an ambitious vision?

Eric Trump's presence in crypto is a net positive in terms of exposure, but exposure alone isn’t enough. The industry doesn't need random bullish tweets or flashy statements. It needs clear, actionable policies that protect investors while encouraging innovation. If Eric focuses on building real solutions rather than just hype, he could become a strong force for crypto. But if he follows in his father’s footsteps—making promises without delivering—it could be another cycle of disappointment.

Eric Trump is far better for crypto than Donald Trump IMO, but that’s not saying much. His enthusiasm is refreshing, and his investments show commitment. However, experience matters, and right now, Eric lacks the track record to prove he can guide the industry in the right direction. If he surrounds himself with the right people and focuses on real solutions, he could become a valuable advocate. Until then, cautious optimism is the best approach.

CZ - Good Or Bad?

Yes, yes we’re at a point where we are asking this question. This thing was in my mind for a while now but I did not think about writing about it. This time, I will because Mike Dudas’s one tweet showing four screenshots I’m adding below, really motivated me.

(1)

(2)

(3)

(4)

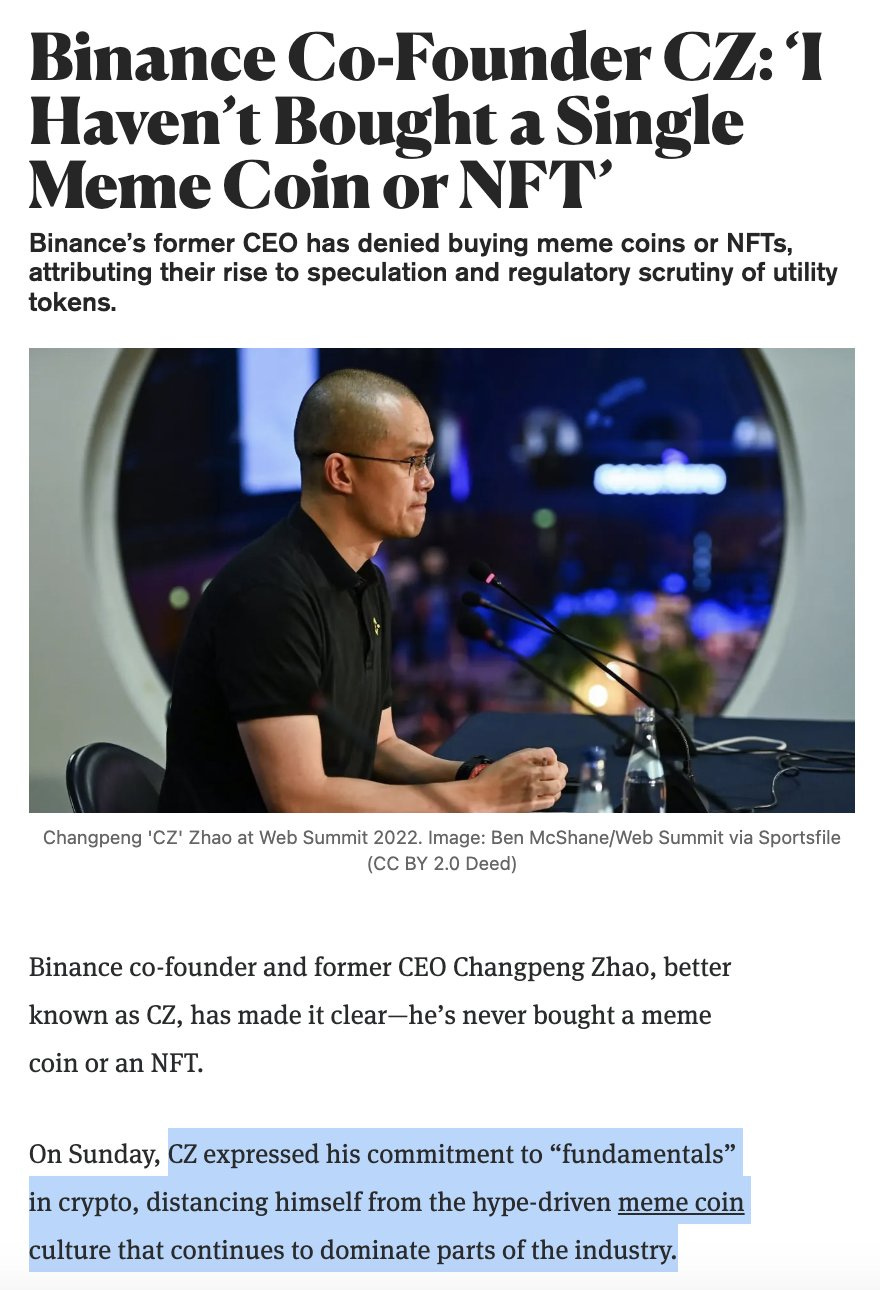

CZ’s Past Criticism of Memes and NFTs

One of the most glaring contradictions comes from CZ’s past criticism of memes and NFTs. Back in the day, he openly dismissed them for their lack of real-world utility, suggesting that they were hype-driven assets with no sustainable value. Given his reputation as a pragmatic leader, this was an expected stance at the time.

But fast-forward to 2024, and memecoins have become the biggest drivers of speculation and engagement in the crypto space. Projects like Dogwifhat (WIF), BONK, and PEPE have outperformed many fundamentally strong tokens, showing that memes are no longer just jokes—they are market forces.

The TST Token Controversy

CZ even slammed Binance for listing the TST token, implying that he had no control over the decision. This raised serious questions about how much influence he still has over Binance or whether he is distancing himself from controversial listings.

However, some see this as damage control—a way for CZ to avoid backlash while still allowing Binance to profit from high-volume meme and speculative trading.

The Dog Named Broccoli – A Strategic Move?

CZ’s recent mention of his dog, Broccoli, is another eyebrow-raising move. While seemingly innocent, it appears strategic. "Broccoli" sounds like the kind of random name that could spark meme mania in the crypto space.

If this was an intentional move, it would align with the idea that CZ is embracing the meme culture he once dismissed. It wouldn't be surprising if a Broccoli token launched soon after.

Binance’s Meme-Centric Voting List

The Binance voting list released recently reflects this shift. It is filled with memecoins, contradicting CZ’s earlier beliefs. Binance, which once prided itself on fundamental-driven listings, now caters to the hype cycle that memes bring.

This move could be strategic—Binance is a business first and foremost, and if memecoins are what retail traders want, then Binance will give them memecoins. However, it also makes CZ look like he has abandoned his original principles.

Has CZ Turned Heel?

It seems like CZ has had to "turn heel" to stay relevant. While his core ideology might still be centered around utility and fundamentals, he has clearly adapted to the new reality where memes drive the market.

Alternatively, one could argue that he has fully embraced the dark side, abandoning his past skepticism and going all-in on the speculative casino that crypto has become.

Either way, one thing is certain: CZ is playing the game, and he’s playing to win.

Crypto Communities - Botted to the brim

It’s frustrating—crypto communities today are nothing but a mirage. At first glance, projects boast hundreds of thousands of followers, engagement numbers that seem sky-high, and comment sections filled with excited supporters. But scratch beneath the surface, and the ugly truth becomes clear: most of it is fake.

The crypto space is drowning in bot armies, and it’s a problem that affects everyone. Many projects—especially new ones—inflate their numbers with fake followers, fake comments, and fake likes just to appear bigger than they are. The worst part? This deception works.

The Exchange Listing Criteria Problem

One major reason behind this bot epidemic is the listing criteria of many exchanges. Some platforms require projects to have a certain number of Twitter (X) followers, Telegram members, or social engagement before they even consider a listing. This leads projects to game the system by artificially boosting their numbers with bots, creating a completely false sense of community strength.

What’s even more infuriating is that some of these projects end up getting listed—all thanks to their illusion of popularity. Meanwhile, legitimate projects with real but smaller communities struggle to get recognized.

For those who don’t research deeply, this bot-driven manipulation paints a completely wrong picture. New investors see a project with 300,000 followers and assume it must be legit and thriving. They see thousands of “supporters” commenting and think there’s real excitement. But in reality, most of these engagements are from empty accounts—paid-for likes, automated comments, and mass-generated retweets.

This misrepresentation is dangerous. People FOMO into projects that have no real backing, only to realize too late that the hype was fabricated.

I’ve Seen It Firsthand

I know this isn’t just speculation—I’ve seen it personally while researching for website articles, X posts, and other content. The same accounts commenting on multiple projects, identical engagement patterns, and obviously fake profiles inflating numbers—it’s everywhere.

Bots have become such a massive issue that real communities often get drowned out. Legitimate discussions are lost under a flood of spam, making it harder to find genuine projects.

Until the industry fixes this broken engagement model, crypto communities will remain botted to the brim—and investors will continue falling for the illusion.

A Look At The Markets

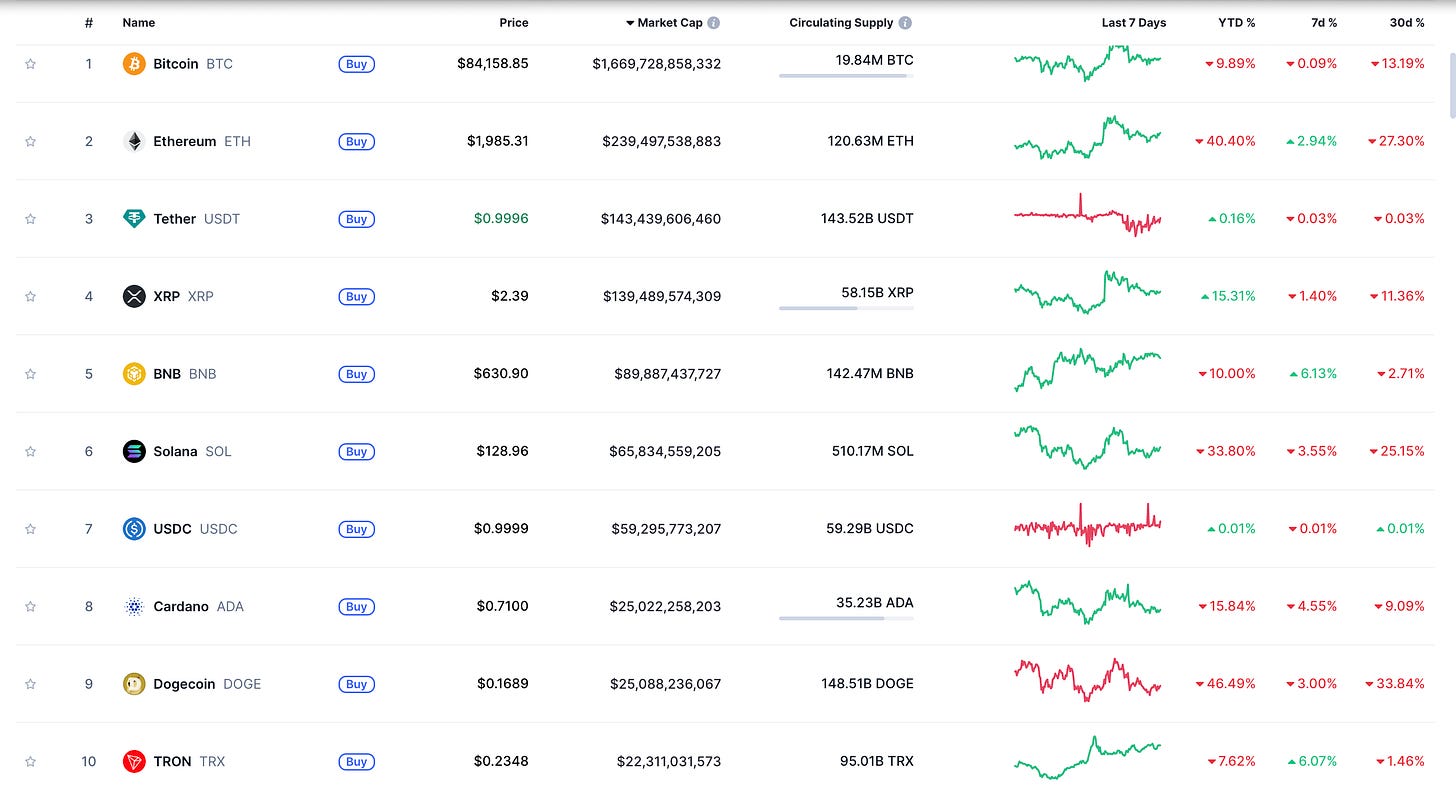

A sideways week saw us move from $2.71T in MC to $2.75T with Ethereum going above $2,000 for sometimes before being pulled by its ankles.

Biggest Winner

$CAKE: Cake takes the cake (yes, I said it) with a 53% pump this week.

Biggest Loser

$PI: Pi does not take the cake (since it’s a Pi, get it?) because now it’s fallen twice in two weeks — this time by 32%.

Unfortunately, I do not have some crazy content for you this week but next week, I promise you we’ll have three of them. Till next time, and till better markets - stay safu!