Hodl Up! Your weekly crypto catch up: Week 50

A much needed correction in the markets, has Solana finally trumped Ethereum when it comes to developers and the HAWK Tuah girl saga. Everything here on this week's Hodl Up!

Welcome to yet another weekly edition of Hodl Up! We are into the last 3 or 4 weeks of the year and Bitcoin is going strong at $102k at the time of writing after a week of pullback and correction.

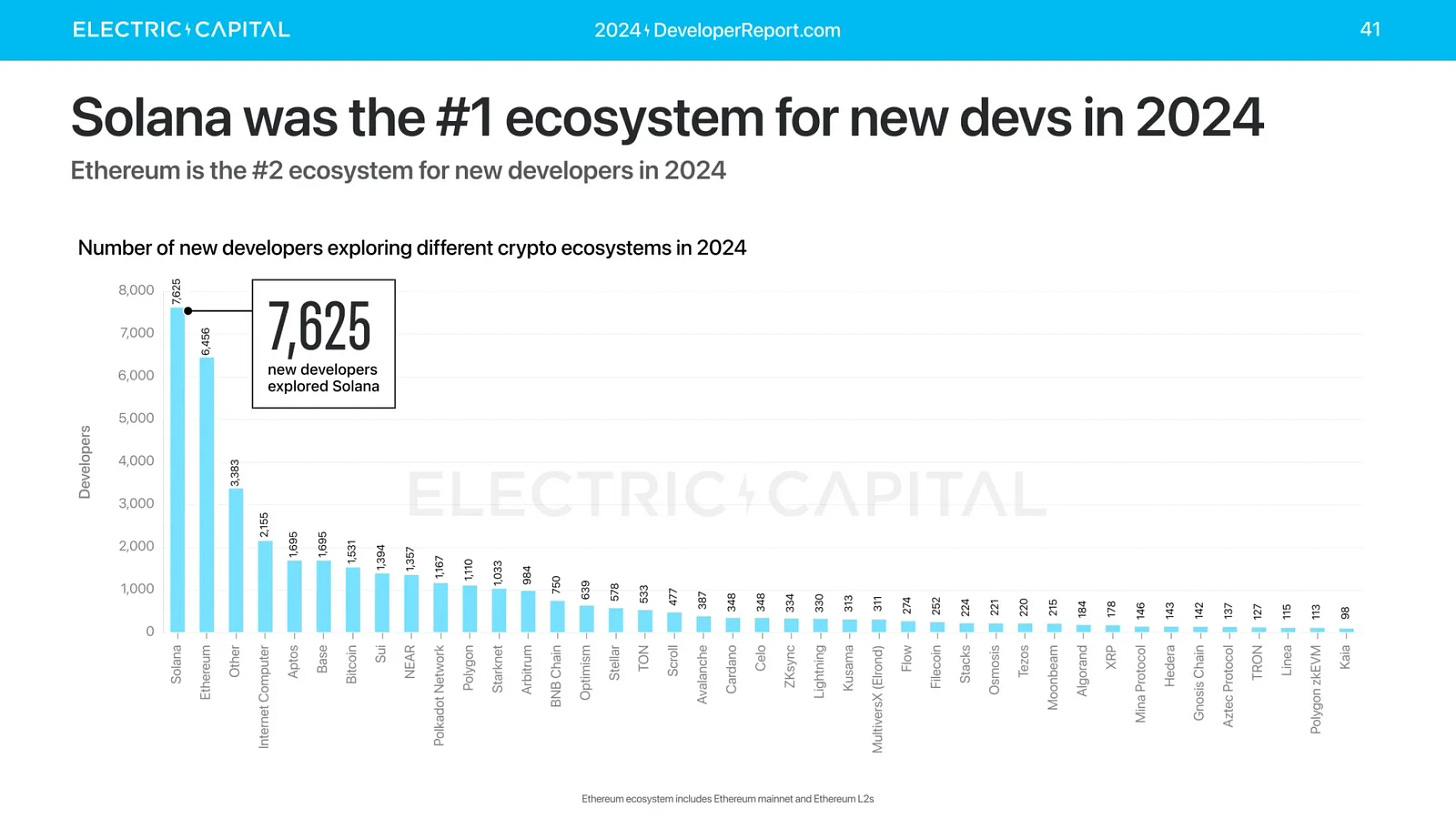

In a latest report we see that Solana has become the preferred ecosystem for new blockchain developers but we will start this newsletter off with two words “Hawk Tuah“

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

The Hawk Tuah Scam

This is a movie about Hailey Welch, popularly known as the Hawk Tuah girl.

Hailey Welch, better known as the "Hawk Tuah girl," soared to internet fame through a quirky viral TikTok moment. At just 22, the Belfast, Tennessee native capitalized on her sudden stardom, building an empire that included a hit podcast, merchandise, and lucrative public appearances. Her rise to fame seemed unstoppable—until the launch of her cryptocurrency, $HAWK, led to a catastrophic rug pull, leaving investors reeling.

Hailey’s $HAWK token debuted with staggering success, quickly achieving a $500 million market cap. Investors flocked to the coin, driven by her widespread popularity. However, within minutes, the coin's value plummeted to $25 million, wiping out 95% of its market cap and devastating its holders. Hailey initially denied wrongdoing, sharing tokenomics that claimed a team allocation of only 10% with a strict lock and vesting period. But blockchain analysis told a different story.

Bubblemaps revealed that 96% of $HAWK's supply was controlled by a single cluster of wallets. Among the 285 presale investors, 89 wallets—including those of Hailey's team—dumped their holdings immediately after the token launch. This sell-off triggered a sharp price collapse, with social media soon erupting in outrage. Victims shared heartbreaking stories: one claimed they were left homeless, while another revealed their grandmother lost $85,000.

Amid the backlash, Hailey’s team attempted damage control with a Twitter Space, only for Hailey to abruptly cancel it, citing fatigue. The incident has cemented $HAWK as one of the crypto world’s most infamous rug pulls, raising questions about celebrity-driven tokens and their impact on unsuspecting investors. As the dust settles, the internet remains divided—some mourn their losses, while others call for justice against the self-proclaimed "Hawk Tuah" sensation.

END OF MOVIE.

Well, I have never ever been a fan of celebrity memecoins, in fact, I’ve always opposed them most my life so I’ll just say this again - “I told you so“.

SOL GOOD, ETH NOT SO GOOD - NEW DEVS

This is something we covered on our website as well but I really feel we need to talk about it here. We all know how $SOL has demolished $ETH so far when it comes to ROI but apparently newer developers are choosing it as their choice of blockchain as well.

I have worked as a blockchain dev in the past and I only ever worked with Ethereum or its L2s but Solana bypassing Ethereum here is huge. It really is.

For the first time since 2016, Solana has overtaken Ethereum as the top destination for new blockchain developers, bringing 7,625 fresh developers into its fold this year.

A genuine question for everyone - does anyone think $SOL could flip $ETH before the next bull run in supposedly 2028-2029? Previously, I always laughed at this proposition but with every passing day, this seems not that distant a possibility.

Well, we’ll have to wait and watch for that but I’m happy for the competition Ethereum and Vitalik are getting.

ETH GOOD, SOL NOT SO GOOD - SEC

The U.S. Securities and Exchange Commission (SEC) has reportedly rejected applications for spot Solana (SOL) exchange-traded funds (ETFs), creating a mix of disappointment and cautious optimism within the crypto community. Multiple applicants, including prominent firms like Grayscale and VanEck, had hoped to bring SOL-based ETFs to market, aiming to expand crypto accessibility. However, the SEC remains hesitant under its current administration, delaying approvals until 2025.

While the rejection stings, the Solana ecosystem has shown resilience. Solana’s price climbed slightly following the news, with its market fundamentals remaining strong. Many analysts predict brighter prospects once SEC leadership changes in early 2025 under newly nominated chair Paul Atkins, a crypto advocate. This transition is expected to create a more favorable environment for digital asset products.

For investors and Solana enthusiasts, this delay may be a blessing in disguise, allowing time for greater market maturity and regulatory clarity. The continued development of Solana's blockchain and increasing adoption may further bolster confidence in future ETF approvals. In the meantime, the community remains optimistic, patiently awaiting regulatory shifts that could unlock significant potential for crypto-based ETFs in the U.S. market.

A look at the markets

Perhaps the most bullish it has been since we began this newsletter. A joy to see the market at $3.66T of market cap. Can we get to $4T in this run?

Biggest Winner

AAVE: Good ol’ lending giant AAVE pumped by a massive $31% but I’ll definitely have to give honourable mentions to LINK 0.00%↑ and $PEPE here.

Biggest Loser

$TIA : I don’t know what’s the case, down by 18% this week, 40% in YTD.

C4 (Crazy Crypto Community Content)

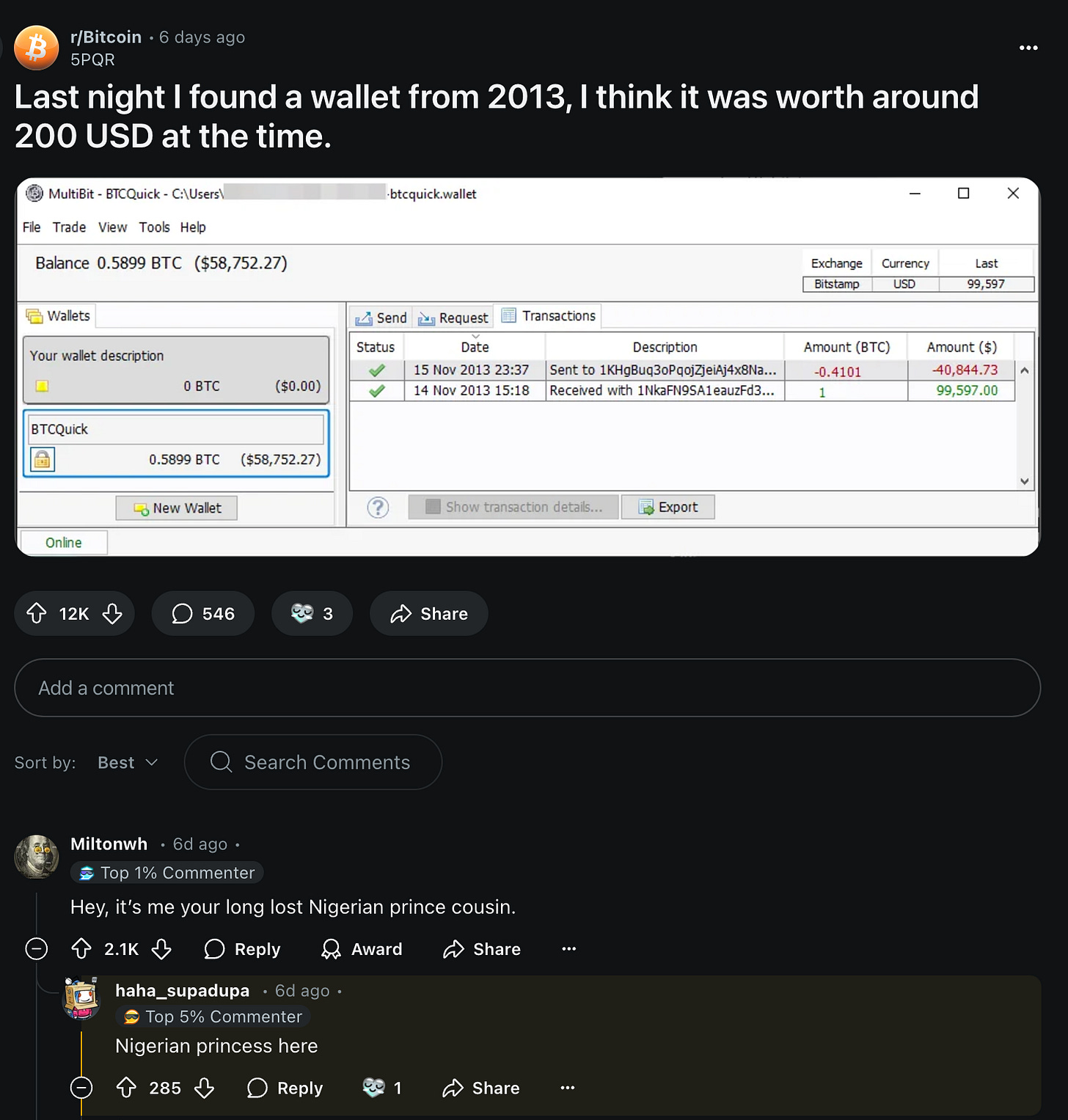

Content 1

You just looking at a lucky lucky man and his Nigerian prince and princess cousins.

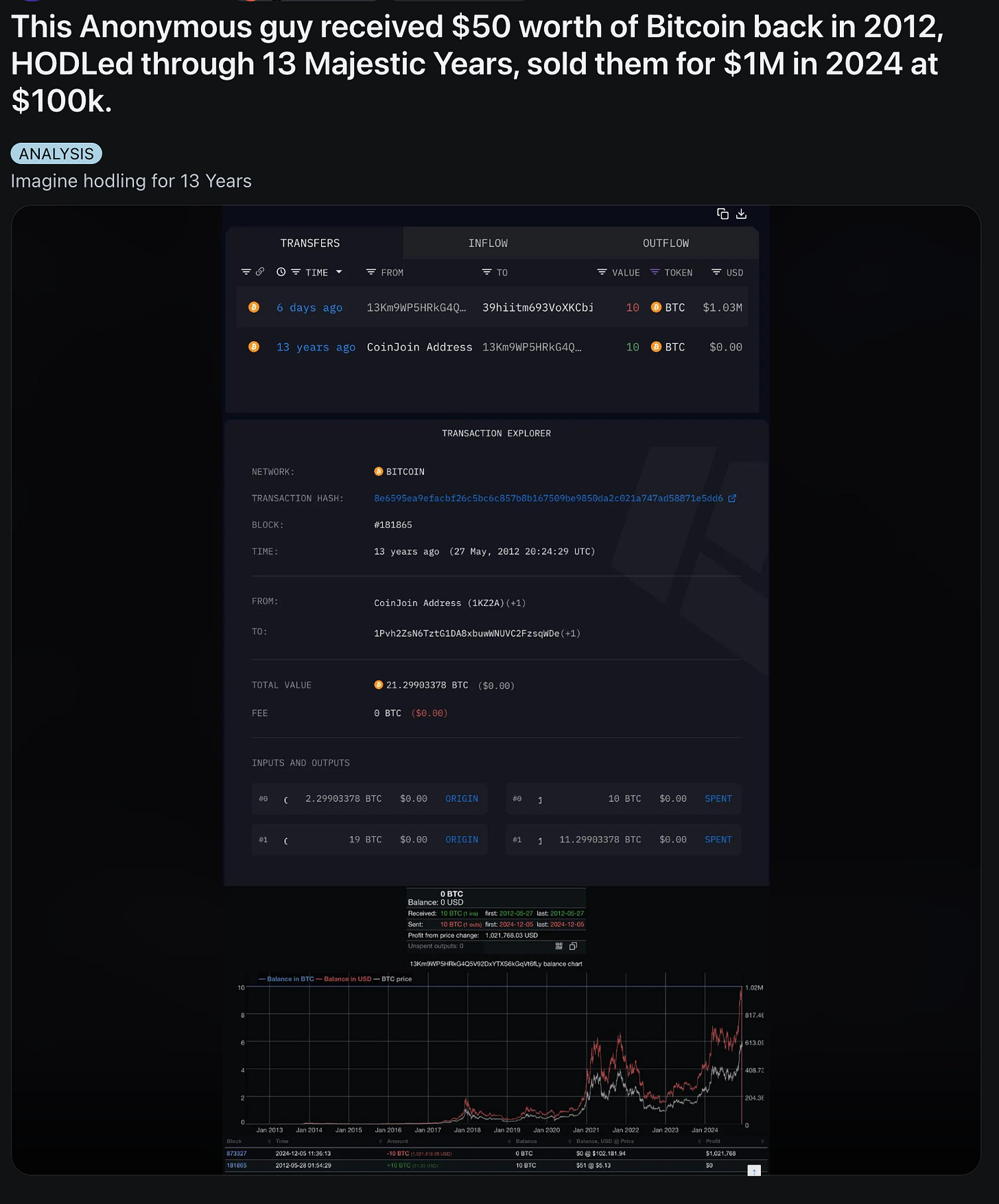

Content 2

Lucky man, part 2.

Well folks, this is it for this week. We’ll meet up again in next week’s hodl up. Until then, STAY SAFU and no HAWK TUAH.