Hodl Up! Your weekly crypto catch up: Week 38 '25

We finally have the rate cuts now, thanks Mr. Powell. Are we already in an altseason (and we just don't know it yet) and why is PayPal tripling down on crypto now?

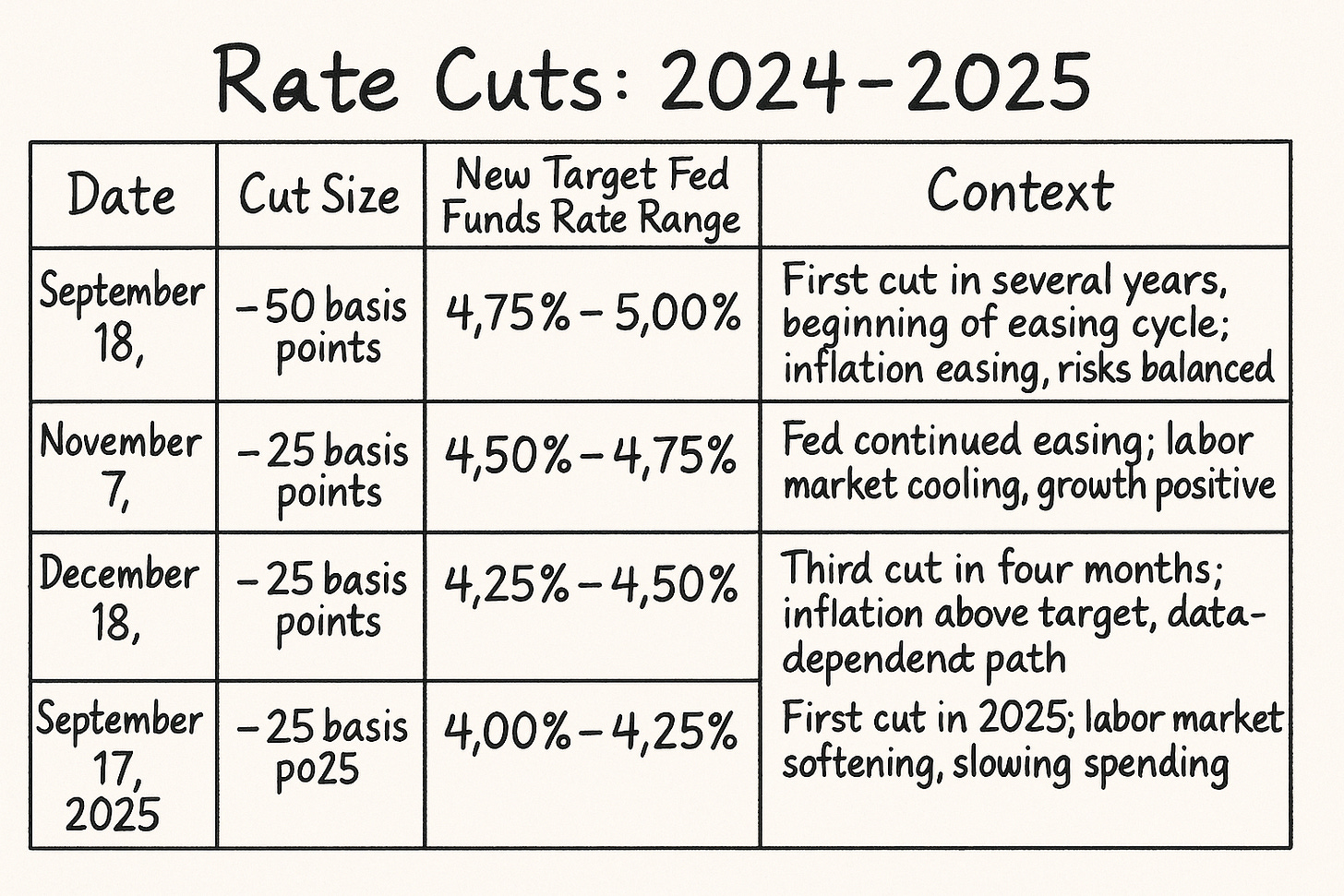

Well well well.. We’ve finally had it - the much awaited rate cuts. Mr. Jerome Powell’s blessings fell upon us with a 25bps rate cut this week. Even though the market has not directly reacted yet, a new sense of hope has been seen everywhere and there are even talks of further cuts in October too. Talk about all of a sudden.

I read a post on X that really caught my attention on how we could already be in an altseason, just ask $BNB. Kidding aside - altcoins have done better than we give them credit for. So, I thought let’s give the ones that deserve credit the credit they are due.

And PayPal - good old PayPal seems to be going all in into crypto now with a couple of strong moves during the week. Just goes to show how much has the industry matured over the past couple of years.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Rate Cuts - Now What?

Well, they did it. The Fed finally pulled the trigger this September with a 25bps rate cut. No fireworks, no panic, just a calm snip off the top, exactly what markets had priced in. For those expecting a big move in crypto… patience. A 50bps cut might’ve sent us to the moon already, but 25bps? That’s more of a slow-burning fuse than a rocket launch.

Still, don’t let the lack of immediate price action fool you. This cut is the clearest signal yet that the tightening era is over. The macro tides are shifting, and risk assets, especially crypto, are quietly gearing up. We’ve entered the “it’s happening, just not all at once” phase.

Let’s talk about the underdogs of this cycle, altcoins. Ethereum, the granddaddy of them all, still hasn’t made a new all-time high this cycle. In fact, it’s kind of embarrassing at this point (stop laughing CZ). Layer 2s are building like it’s 2021, staking is up, institutional ETH flows are trickling in… and yet, price action? Meh.

Altcoins, especially ETH, need these rate cuts like Vitalik needs new shoes. Lower rates mean higher risk appetite, and alts thrive in that environment. Bitcoin’s been stealing the spotlight with ETFs and the digital gold narrative, but when real liquidity starts flowing, it trickles down. ETH and friends just need a bit more macro tailwind, and this cut is a start.

Now here’s where it gets interesting. Socials are buzzing about another 25bps cut potentially coming up. If that materializes, that could be the real unlock moment. Two cuts in a row would scream “we’re back, baby” to the markets. We saw it in late 2024. Call it whatever you may, late 2024 was a good time for altcoins.

So yes, I’m hopeful. Hopeful for a good market ahead because of the 25bps cut and praying for another cut in October. 🤞

PayPal And Crypto - Fitting In

PayPal is clearly not here to play tourist in crypto anymore. The company just unveiled PayPal Links, a new feature that lets users in the US create simple, one-time links to send or request money through PayPal or Venmo. What makes this spicy is that crypto support is coming soon. You’ll be able to send Bitcoin, Ethereum, PYUSD, and more using these links, no wallet addresses or QR codes required. Just send the link and boom, the money (or tokens) move.

The best part? These peer-to-peer crypto transfers between friends and family will not trigger 1099-K tax forms, at least for now. That alone will make it a no-brainer for casual users who want to avoid the paperwork nightmare. Think splitting dinner in ETH, sending BTC for a birthday gift, or collecting rent in PYUSD without needing to explain it to your accountant later.

Meanwhile, PayPal is also taking a big leap on the stablecoin front. Its upgraded stablecoin, PYUSD0, is making the jump across chains with full multichain support. Thanks to a new bridge rollout, PYUSD0 is now live or expanding on Avalanche, Sei, Aptos, Tron, and others. This isn’t just a few testnet trials either. We’re talking full ecosystem integrations that allow the same stablecoin to move seamlessly between chains.

This is a major unlock. PYUSD0 will behave like real digital cash across different blockchains. No more wrapping and unwrapping hassles, no guessing which version of the coin is compatible with which protocol. Whether you’re swapping on a DeFi app on Sei or paying a freelancer on Aptos, the experience will feel much smoother and unified.

What PayPal is building here is starting to look like a real infrastructure play, not just a payments feature. They’re betting on stablecoins being more than just on-ramps or trading pairs. They’re positioning PYUSD0 as the connective tissue for crypto commerce, and the P2P crypto links are the friendly interface that brings it all together.

I think this has a lot to do with the GENIUS bill passing, a lot of conventional financial companies are going to get into crypto more and more. The revolution, my friends, is here.

Altseason, We are in an Altseason

I saw this post on X.

Over the last 90 days, 75% of the Top 50 coins outperformed Bitcoin. That is really not bad.

Of course I know this is not the kind of altseason you guys have been waiting for (see how I said you, not we). But just let the info above sink in, the market has not been bad. In fact, it’s been quite good going into the rate cuts and ETFs now.

The fruit is very ripe and there for the taking. Look at the likes of $PENGU, $CRO, $MNT, SEI 0.00%↑ . Great numbers vs Bitcoin.

Sure, we’re not in full-blown mania mode with meme coins doing 100x overnight, but large caps are quietly gaining ground. Ethereum, Solana, Avalanche, and others have been grinding higher, building real momentum while the crypto crowd scrolls X wondering when altseason will “officially” start.

Large caps tend to lead the early phases of an alt run, pulling in capital first before the mid and low caps follow. If you’re only watching Bitcoin dominance and waiting for a dramatic breakdown to signal rotation, you might miss the fact that it’s already happening, just more slowly and selectively than usual.

So while it’s not time to pop the champagne yet, it’s also not the time to sleep on what’s already moving. Quiet outperformance is still outperformance.

A Look At The Markets

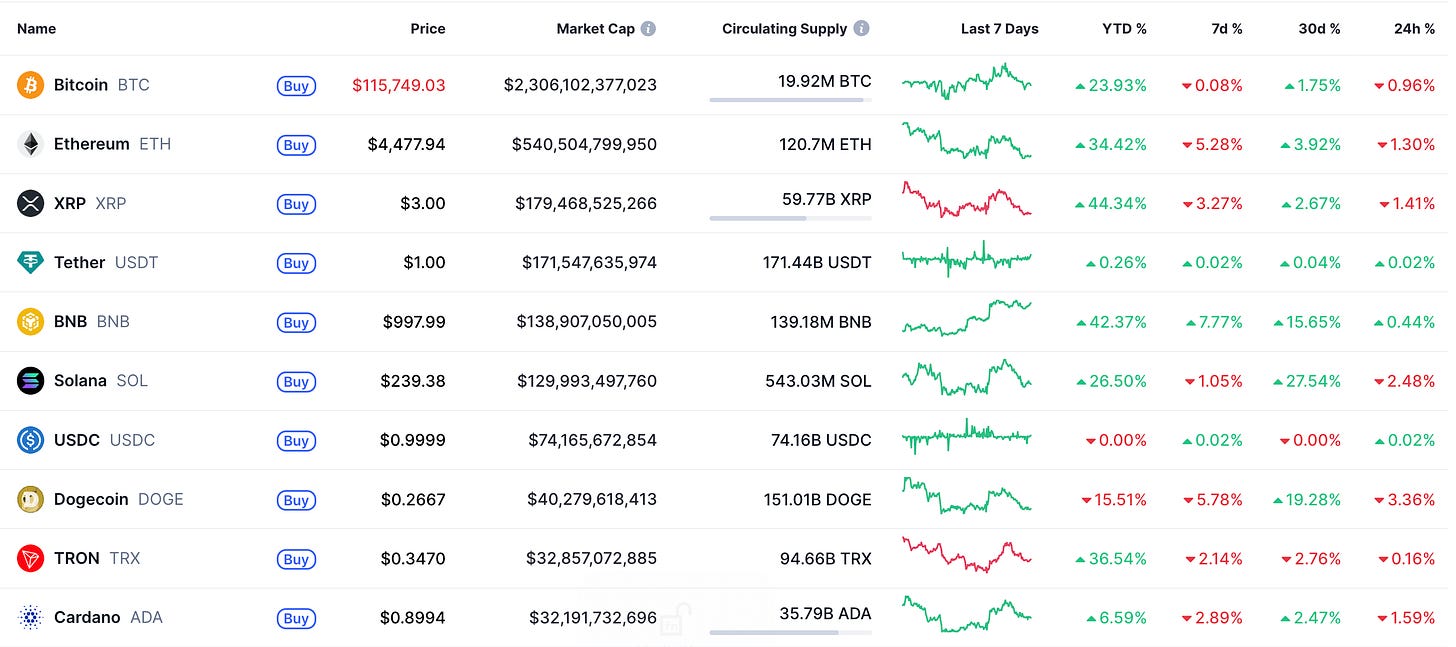

This has been an up and down week to be honest. We did shoot up to $4.12T in TOTAL MC but now we’re back to $4.04.

I think $ETH has really slipped this week and we just have to applaud $BNB yet again. It was at $927 last week when I sang its praises, it crossed $1000 and is at $997 right now. Mantle.

Biggest Winner

$BNB: We have to, yes, it’s not the biggest gainer but it never is. But we have to. If you are the 2nd/3rd best gainer for weeks and weeks - you deserve this $BNB.

Live your life.

$ASTER: There are two winners because well… people who don’t know $ASTER yet. Please use the internet.

Biggest Loser

$MYX: I had such a hunch this was going to happen. I even wrote it last week while crowing $MYX the winner. Well, it still is 1000% up in 30d so I don’t think its holders mind a 20% drop.

Well, that is it for this week on HodlUp! Hopefully the market starts getting greener the upcoming week and we have the largest Q4 that we have ever had (don’t kill my dreams). Until then, STAY SAFU!