Hodl Up! Your weekly crypto catch up: Week 18 '25

We are back after some holidays and so is the crypto market (at least, BTC). This week we'll see how coins die, why China has been accumulating Bitcoin and how did Token2049 in Dubai go.

After a 3 week break, we are back with Week 18 of HodlUp! and with no connection to me being missing is the fact that crypto markets have recovered decently well since we all talked 3 weeks ago. The TOTAL market cap is a healthy $3.00T and $BTC has been testing $97-$98k in the past couple of days.

The biggest yearly event in crypto, the Token2049 concluded in Dubai and we’ll take a look at the major things that happened there along with a very interesting news article I read somewhere this week on how many coins have just “died“ in the past few years from the market.

NOTE: NOTHING EVER MENTIONED IN ANY OF OUR CRYPTO TALK’s POSTS/NEWSLETTERS/CONTENT IS FINANCIAL ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Gold vs Bitcoin: The age old (10 years) debate

Ah yes, the classic showdown: the ancient metal that sank Spanish galleons vs. the digital currency that melts Twitter servers. Gold has been the go-to store of value for millennia, it's shiny, it doesn’t rust, and you can wear it around your neck without getting locked out of your crypto wallet. But enter Bitcoin: the rebellious, code-based contender barely out of adolescence (just turned 16), yet already giving the yellow rock a serious run for its money.

Gold, bless its heart, just kind of sits there. It doesn’t do much besides look pretty and hang out in vaults. Bitcoin, on the other hand, is programmable, borderless, and can be zapped across the world in minutes. Sure, it has its mood swings (also known as “volatility”), but it’s like comparing a rollercoaster to a rocking chair—one might give you motion sickness, but it’s a heck of a ride.

The argument for gold often comes with words like “tangible” and “historical precedent.” Fair enough. But we also used to mail letters and rent DVDs. The world’s moving on. Bitcoin is like gold’s cool, hoodie-wearing grandchild who just figured out how to bypass the banks and the bureaucracy in one line of code.

In a world increasingly ruled by digits and data, Bitcoin isn’t just digital gold—it’s what gold would be if it were invented by Satoshi Nakamoto instead of pulled out of a riverbed.

2025 so far has been a wild year, majorly due to American tariffs but some other factors as well - markets have been crashing and people are looking at their good old friend - Gold. Some more than other. Some is China.

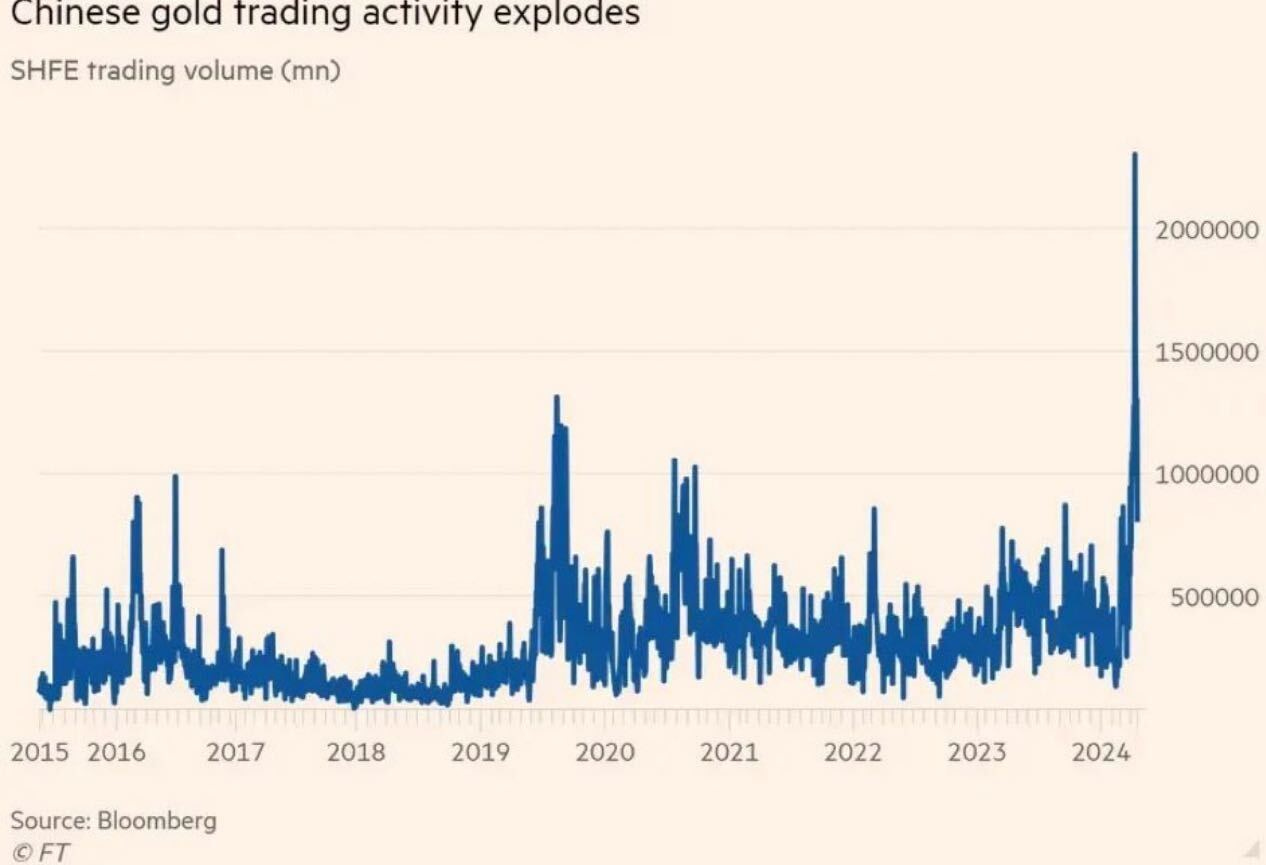

For all practical purposes, Bitcoin is out of the picture in China. No mining, no trading, no decentralized dreams. And so, 2025 has seen China’s gold trading volume surge like a dragon on Red Bull. Prices? Sky high.

Here’s the kicker: in a country of over a billion people, one of the most transformative financial inventions of our time, Bitcoin - is off the table. And that absence might just explain the explosive growth in gold demand. It’s the only store of value left standing for many.

Now imagine the untapped potential if that same population could access Bitcoin. We're talking about an entirely different trajectory, not just for Bitcoin, but for financial freedom. China may be embracing gold now, but the mere fact that Bitcoin isn’t even in the ring makes you wonder just how lopsided this fight really is.

Coins: More Dead Than Alive

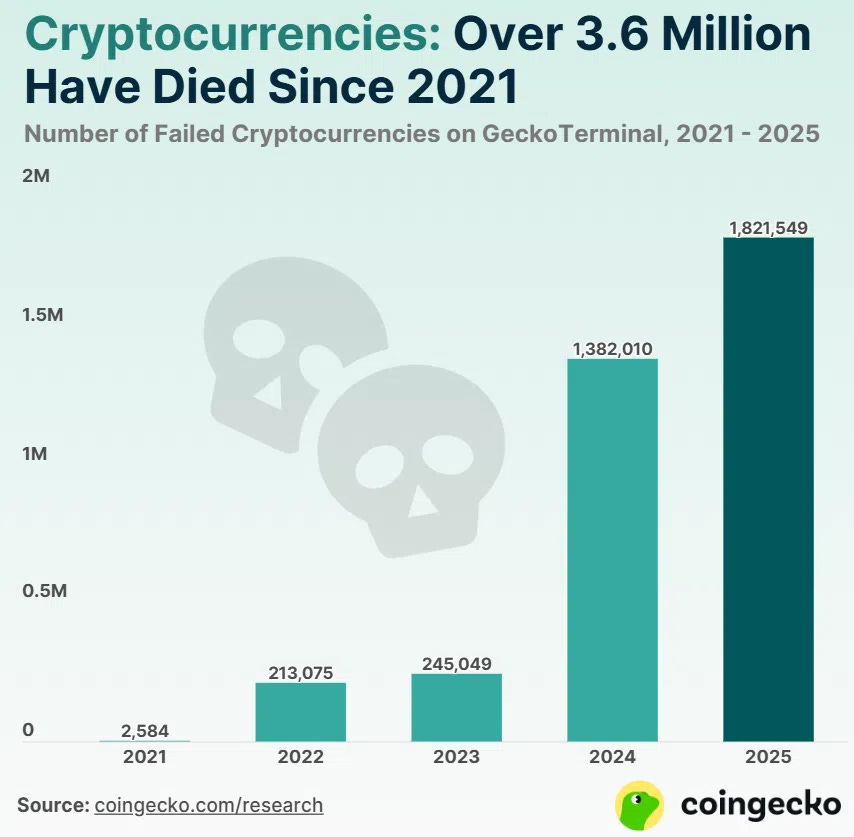

If the crypto market were a zombie flick, we’d be waist-deep in undead tokens clawing at the gates of liquidity. Inspired by a recent report from Coingecko, it turns out over 50% of all cryptocurrencies have failed, and not the poetic kind of failure. We’re talking full-on rug-pulls, ghost towns, and tokens with more tumbleweeds than traders.

Since 2021, nearly 7 million coins were listed on GeckoTerminal. Today? 3.7 million are no longer trading. That’s 52.7% of all coins—gone, kaput, vanished into the digital ether. The bulk of this mass extinction didn’t come gradually either. Nope, the bloodbath hit its peak during 2024 and the early days of 2025, with Q1 2025 alone witnessing the death of 1.8 million tokens. That’s nearly half of all failed crypto projects ever—in just three months.

So what killed the coins?

Well, a few suspects stand out. First, pump.fun - an ironically named launchpad that turned token creation into a joke so easy even your cat could launch a coin. Meme coins, scams, and low-effort projects flooded the ecosystem like spam in a neglected inbox.

Then came market turbulence. The political sphere didn’t help, Donald Trump's 2025 inauguration coincided with a broad market downturn, sending weak projects straight to crypto heaven (or purgatory, depending on how bad the smart contract was).

It’s not all doom and gloom - this great extinction might just be the detox crypto needed. Because while meme coins fall like flies, the serious players—the ones building real utility, get to breathe easier. Or at least scroll GeckoTerminal without crying.

TOKEN2049 Dubai 2025

Over 15,000 crypto heads packed the venue for two days of blazing hot takes, bullish bets, and more Ledger giveaways than a bear market survivor could dream of. Between political surprise guests, industry legends, and some wild predictions, the message was clear: crypto’s not just alive, it’s kicking down the doors of global finance.

Here are five of the biggest moments from the desert’s most hyped blockchain bonanza:

CZ’s Comeback: “One Rulebook to Rule Them All”

In one of the most anticipated appearances of the event, Changpeng “CZ” Zhao made his grand return to the public stage. No longer CEO of Binance, CZ walked on like a rockstar and the crowd treated him like one. In a refreshingly open chat, he praised Dubai for being a haven of crypto sanity and dropped a few philosophical nuggets, like “financial freedom depends on free speech.”

But he didn’t stop there. CZ called out the inefficiency of regulators creating fragmented laws in every jurisdiction: “Doing the same compliance work 200 times? Not scalable.” Basically, he’s still pushing for a global regulatory framework, one guidebook, not 200 translation manuals.

Eric Trump Steals the Show (Yes, Really)

Surprising absolutely everyone, Eric Trump took the stage and leaned hard into the crypto hype. “We’re still in the dial-up phase of crypto,” he declared, drawing cheers and raised eyebrows alike. He praised the UAE’s lightning-fast permit process, apparently, it took just one month for the Trump Organization to get clearance to build a new luxury tower in Dubai… where you’ll be able to buy units in Bitcoin.

Sharing the stage with Justin Sun, Eric didn’t hold back: “Cryptocurrencies will take over traditional finance and leave big banks in the dust.” Dramatic? Sure. But in a week filled with moon-talk, it fit right in. One speaker even shouted, “SWIFT is broken - it’s crypto time!”

Hardware Wallets Are the New Conference T-Shirts

Crypto swag hit a new level when exchange BYDFi teamed up with Ledger to drop a limited-edition Nano X. Attendees who completed a few simple tasks got to walk away with a legit hardware wallet, no raffle, no catch. People lined up like it was a sneaker drop.

Beyond the cool giveaway, BYDFi used the moment to spotlight their new on-chain trading platform, MoonX—a blend of DeFi transparency with centralized speed. That’s right, even exchanges are leaning into the “not your keys, not your coins” movement. Self-custody just got stylish.

$1 Million Bitcoin by 2028? Arthur Hayes Thinks So

Arthur Hayes, never one to understate things, brought the house down with a prediction that Bitcoin could hit $1 million by 2028. “Go all in,” he said, grinning like someone who knows something the rest of us don’t. While the crowd erupted in cheers, some speakers offered a dose of reality—VanEck’s CEO warned not to chase Ethereum ETFs just because they're shiny, and Bloomberg’s Eric Balchunas cracked jokes about potential “Trump or Melania ETFs.”

It was classic Token2049: half moonshot prophecy, half financial therapy session. But love him or hate him, Hayes made one thing clear—big moves are coming.

$300 Million Says Web3 Isn’t Dead

Just when you thought the startup funding scene was slowing down, MEXC Ventures showed up with a flex: a fresh $300 million fund aimed at building the next wave of Web3 projects. Think DeFi, infrastructure, stablecoins—the works.

In a time when even solid projects struggle for runway, this was a jolt of adrenaline. And with crypto VC funding already rebounding in 2025, MEXC’s big bet is a strong signal that the build phase is back on.

Final Thoughts: Crypto Has Entered Its Wild Phase—Again

Token2049 in Dubai was part rally, part revival. It had luxury towers, free wallets, viral quotes, political curveballs, and yes—camels lounging outside the venue. But most of all, it had energy. The kind of energy that says crypto isn’t just surviving the winter—it’s preparing to rewrite the rules of global finance, one meme coin and mega-fund at a time.

If 2025 was still in question, Token2049 answered it loud and clear: the future is still decentralized, still unpredictable, and still very, very bullish.

A Look At The Markets

The total market cap sits at $3.00T at the time of writing with Bitcoin at $96,522. Bitcoin has the highest dominance levels in the market in the last 4 years and the altcoin race is being run at a very slow pace to be honest. Hopefully that can change if $ETH can hit at least $2,000 asap.

Biggest Winner

$VIRTUAL: After being a loser for many many months, $VIRTUAL has had a great recovery arc this month with a 208% pump in the last 30 days.

Biggest Loser

$MOVE: The bad bad case of Movement labs sees them drop 23% in the last 7 days, which to be honest is not that bad considering the situation of suspending their co-founder and such.

Well, that is it for this week my friends. Hopefully the first week of May gets us a very green market and we can finally see $ETH and the altcoins decrease Bitcoin dominance a bit. Until then, stay SAFU!